Introduction

A Bitcoin investment calculator is one of the smartest tools a crypto investor can use. It takes the guesswork out of profit estimation by showing you exactly how much you could earn—or lose—based on your entry price, exit price, and holding period.

As Bitcoin continues to dominate headlines and draw new investors in 2025, planning your trades with data has never been more important.

Whether you’re a beginner making your first investment or a seasoned trader managing long-term positions, using a calculator gives you instant clarity. You’ll be able to forecast returns, assess risks, and make informed decisions based on numbers—not emotion.

From simple profit calculations to advanced tax estimation and real-time projections, today’s Bitcoin calculators do more than crunch numbers—they empower you to trade smarter.

If you’re new to crypto investments, check out our list of crypto calculators for in-depth insights.

Key Takeaways

- A Bitcoin investment calculator helps estimate your potential profit or loss based on price inputs, time held, and fees.

- It removes emotional guesswork by offering data-driven projections.

- Calculators can simulate historical ROI and forecast future returns.

- Many tools now include real-time data and capital gains tax estimations.

- It’s a must-have for both beginner and advanced crypto investors looking to manage risk and optimize timing.

What Is a Bitcoin Investment Calculator?

A Bitcoin investment calculator is a digital tool that helps you estimate how much money you could earn—or lose—based on your Bitcoin trades. Instead of manually calculating your return, this tool automates the math by using inputs like your buy price, sell price, amount of BTC, and time held.

It doesn’t predict the future. Instead, it gives you a clear projection based on the numbers you enter. Want to know how much you would’ve made if you bought Bitcoin in 2020 and sold it in 2025? Or how much you might earn if Bitcoin hits $100,000 in five years? That’s exactly what this calculator shows you.

Most calculators work by applying this simple formula:

Profit = (Selling Price – Purchase Price) × BTC Amount – Fees

More advanced tools also let you factor in:

- Holding period (for capital gains tax estimation)

- Exchange fees or network costs

- Currency conversion (if you’re trading in non-USD)

Whether you’re planning a future trade or reviewing past performance, a Bitcoin investment calculator helps you see the big picture—and make better moves because of it.

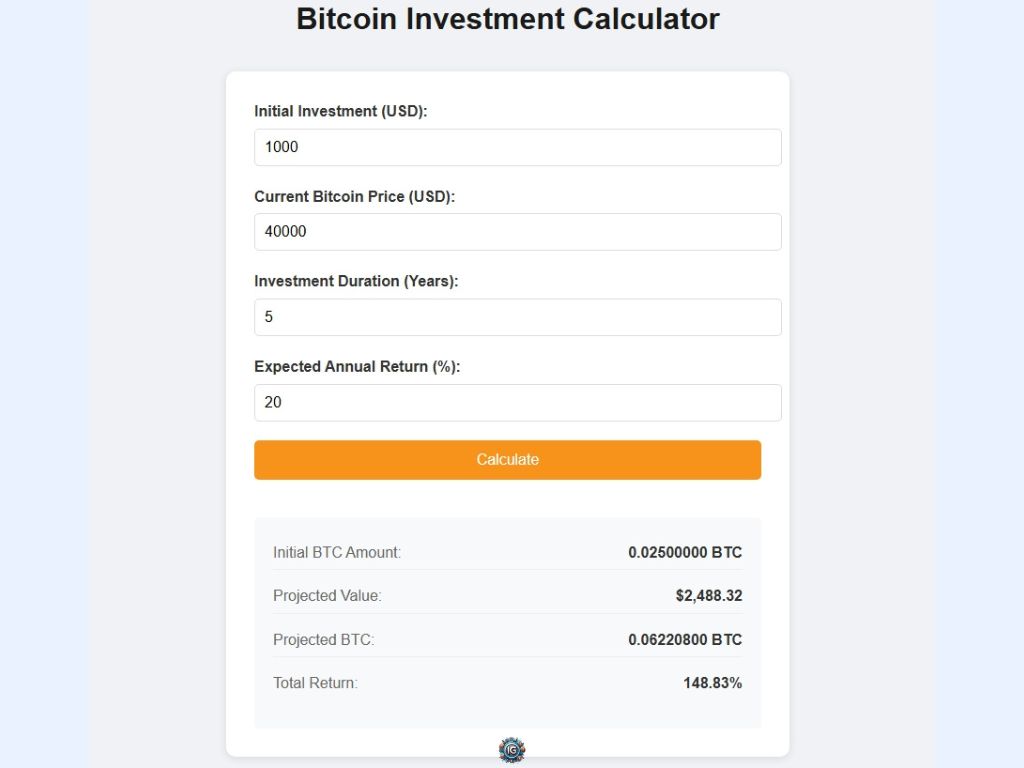

How A Bitcoin Investment Calculator Works: Inputs You’ll Need

A Bitcoin investment calculator works by turning a few simple inputs into a clear projection of your potential return. The more accurate your data, the more useful your result. Here’s what you’ll typically need to enter:

1. Initial Investment

This is the total amount of money you used to purchase Bitcoin. Whether you invested $100 or $10,000, this forms the basis of your calculation.

2. Purchase Price (Entry Price)

The price per Bitcoin when you bought in. If you bought a fraction of Bitcoin at $28,000 per BTC, that’s the number to enter here.

3. Selling Price (Exit Price)

This is either the price at which you sold your Bitcoin or the price you plan to sell. It’s key for calculating profit or projecting future gains.

4. BTC Amount

The amount of Bitcoin you purchased. Even if you bought 0.05 BTC, the calculator needs this number to determine your total value at selling time.

5. Holding Period (Optional)

Some calculators ask how long you plan to hold your investment. This helps with ROI over time, especially when comparing growth scenarios or estimating tax liability.

6. Transaction Fees

Every trade comes with fees—either from the exchange or the network. Inputting the total fees gives you a more accurate net profit estimate.

Once you input these variables, the calculator will show your:

- Total Return

- Net Profit or Loss

- Percentage Gain or Decline

- Optional: Tax Estimation if supported

This makes it easy to adjust different price points and timelines, test your strategies, or simulate what-if scenarios based on market performance.

Example Calculation: From $10K to Profit

To see how a Bitcoin investment calculator works in real life, let’s walk through a simple example using a $10,000 investment.

Scenario: You bought Bitcoin at $30,000 per BTC in 2023 and plan to sell it in 2025 at a projected price of $50,000. You purchased 0.3333 BTC (approximately) and paid $150 in total fees.

Here’s how the calculator breaks it down:

- Initial Investment: $10,000

- Entry Price: $30,000

- Amount Bought: 0.3333 BTC

- Projected Selling Price: $50,000

- Gross Value at Sale: 0.3333 × $50,000 = $16,665

- Profit Before Fees: $16,665 – $10,000 = $6,665

- Net Profit After Fees: $6,665 – $150 = $6,515

Result: If Bitcoin reaches $50,000, your $10,000 investment would grow to $16,665, giving you a net profit of $6,515 after fees.

This kind of visualization is what makes investment calculators so valuable. They let you test future possibilities and measure the upside—or downside—of your strategy before putting any money at risk.

Want to see your own outcome? Input your numbers into a trusted Bitcoin calculator and compare different sell prices or holding periods to create your ideal exit plan.

Why Historical Data Matters

Bitcoin’s price history isn’t just a story of past performance — it’s a powerful tool for shaping future decisions. A Bitcoin investment calculator becomes even more useful when paired with historical data, allowing you to simulate “what if” scenarios that reveal the long-term potential of your investments.

For example, imagine investing $1,000 in Bitcoin during early 2017 when the price was around $1,000. By late 2021, when Bitcoin hit $60,000, that same $1,000 would have been worth over $60,000 — a 60x return. Calculators that include historical price data let you test these scenarios with a few clicks.

By analyzing past bull and bear markets, you can:

- Understand how long it took Bitcoin to recover from major dips

- Recognize patterns in price cycles

- Make more informed assumptions when projecting future returns

Historical data doesn’t guarantee what’s next, but it shows what’s possible. It gives your strategy context, and your expectations, balance.

Many of the top Bitcoin calculators integrate historical price charts or offer options to simulate past trades. This lets you look beyond hype and headlines — and instead learn from real market behavior.

Benefits of Using a Bitcoin Investment Calculator

Using a Bitcoin investment calculator isn’t just about seeing potential profits — it’s about making smarter, more informed decisions. Whether you’re planning a trade or managing a long-term portfolio, these tools offer several key advantages:

Smarter Portfolio Planning

A calculator helps you visualize your potential gains or losses before you make a move. This lets you build a more intentional investment strategy and avoid spur-of-the-moment decisions based on market hype or fear.

Clear Risk Assessment

By adjusting inputs like exit price or holding period, you can instantly see how different scenarios affect your outcome. This makes it easier to measure downside risk and build confidence in your strategy.

Tax Estimation (With Advanced Tools)

Some calculators include capital gains tax estimators, helping you prepare for real-world costs and avoid surprises at tax time. This is especially helpful for investors planning large exits.

Long-Term Goal Tracking

Set a target price, plug in your numbers, and instantly see what it takes to hit your financial goal. Whether you’re aiming for a $5,000 gain or retirement-level returns, the calculator makes your plan tangible.

Improved Emotional Discipline

When the market swings, emotional decisions lead to poor outcomes. A calculator gives you facts — not feelings — and helps you stick to your strategy even in volatile conditions.

These tools turn abstract ideas like “what if Bitcoin hits $100K” into real, measurable outcomes. That clarity can be the difference between guessing and growing.

Best Bitcoin Investment Calculators in 2025

Not all Bitcoin calculators are created equal. Some focus on simple profit estimations, while others offer deeper features like historical data tracking, tax estimations, and portfolio analysis. Choosing the right tool depends on your experience level and what insights you need most.

Here are some of the most reliable and user-friendly Bitcoin investment calculators available in 2025:

1. CoinMarketCap Bitcoin Calculator

CoinMarketCap’s calculator is straightforward and fast. It lets you input your purchase and selling prices to see instant ROI and profit projections. It also pulls in real-time BTC prices to keep your estimates accurate.

Best for: Beginners who want a clean, no-frills tool.

2. CryptoCompare Investment Calculator

CryptoCompare goes beyond basic profit calculations. It allows you to include transaction fees, time held, and compare different crypto assets side by side. It’s ideal for investors who want to analyze performance more thoroughly.

Best for: Intermediate traders focused on detailed ROI breakdowns.

3. Investing.com Crypto Calculator

Known for its market analysis tools, Investing.com offers a crypto calculator with historical pricing, trend data, and chart overlays. This tool is helpful for those who want to model longer-term projections with historical insight.

Best for: Investors doing multi-year planning or scenario analysis.

4. CoinCodex Profit Calculator

CoinCodex includes tax-aware projections and an easy-to-use interface for simulating trades. It also supports thousands of altcoins in addition to Bitcoin.

Best for: Traders managing multi-coin portfolios and estimating after-tax profits.

5. BuyBitcoinWorldwide’s Profit Calculator

Designed for simplicity, this tool focuses on historical investments. You can select a past date, input an amount, and see how much your investment would be worth today.

Best for: HODLers and new investors curious about “what if I bought in 2015?” scenarios.

Each tool serves a specific use case — whether you’re forecasting, analyzing past investments, or planning a profitable exit strategy. Start with the one that fits your goals today, and scale up to more advanced tools as your trading knowledge grows.

Future Value Forecasting: BTC in 2030–2035

What if Bitcoin hits $100,000? $250,000? Or even $1 million?

While no one can predict Bitcoin’s exact future price, using a calculator to forecast different growth scenarios helps you understand potential outcomes — and prepare for them. A Bitcoin investment calculator lets you simulate long-term gains based on projected prices years into the future.

Let’s say you invest $5,000 in Bitcoin at $30,000 per BTC. That gives you roughly 0.166 BTC. Now, plug in future price targets:

- At $100,000 BTC: 0.166 × $100,000 = $16,600

- At $250,000 BTC: 0.166 × $250,000 = $41,500

- At $500,000 BTC: 0.166 × $500,000 = $83,000

Even after accounting for taxes and fees, the long-term potential is clear — and it’s one of the reasons Bitcoin continues to attract global interest.

A future-value scenario calculator helps you:

- Set realistic investment goals

- Build timelines for profit-taking

- Understand compounding growth with reinvestment

- Avoid emotional exits by anchoring to data

Of course, these projections aren’t promises. They’re planning tools — and they’re most powerful when combined with a disciplined strategy, proper security, and continuous learning.

So whether you’re targeting 2030, 2035, or beyond, run the numbers. A small decision today could be worth far more tomorrow.

Common Mistakes to Avoid When Using a Bitcoin Calculator

Bitcoin investment calculators are useful, but they’re not crystal balls. Many investors misuse them or misunderstand what the results really mean — which can lead to poor financial decisions. Here are the most common mistakes to avoid:

1. Treating Calculators as Price Predictors

A calculator shows what could happen, not what will happen. It’s a planning tool, not a guarantee. Always remember that market conditions, regulations, and sentiment can shift rapidly.

2. Ignoring Fees and Taxes

Leaving out trading fees, gas fees, or capital gains taxes leads to inflated results. Make sure to factor in all possible deductions to get a realistic estimate — especially if you’re planning large investments or multiple trades.

3. Overestimating Growth Projections

It’s tempting to plug in future prices like $500,000 or $1 million per BTC. While exciting, these high targets can distort your strategy. Test conservative scenarios too, so you’re prepared no matter what direction the market moves.

4. Using Inaccurate Input Data

If you don’t know the exact amount you invested or the true purchase price, your output will be off. For the best results, double-check your transaction history and use precise numbers.

5. Making Emotional Decisions Based on Hypotheticals

Calculators can spark excitement — but don’t let imagined gains push you into risky trades or FOMO buys. Let the numbers guide your strategy, not dictate impulsive moves.

6. Not Updating Calculations Over Time

Markets change. A projection made six months ago may no longer be relevant today. Revisit your calculator periodically and adjust your inputs based on updated goals, price action, and portfolio performance.

Used properly, Bitcoin calculators provide incredible clarity. But like any financial tool, they work best when paired with logic, discipline, and a realistic outlook.

Frequently Asked Questions (FAQs)

How do I calculate Bitcoin profit manually?

Use this formula: (Selling Price – Purchase Price) × BTC Amount – Fees. A calculator automates this, reducing the chance of error and saving time.

Can a Bitcoin calculator predict future prices?

No. Calculators estimate potential profits based on the prices you input. They can’t forecast the market — they help you test scenarios and plan accordingly.

Are Bitcoin investment calculators free to use?

Yes. Most trusted tools like CoinMarketCap, CryptoCompare, and CoinCodex offer completely free calculators with optional advanced features.

What’s the difference between a Bitcoin calculator and a crypto ROI calculator?

A Bitcoin calculator focuses on BTC trades. ROI (Return on Investment) calculators can analyze any coin, staking yields, or even DeFi returns over time.

Can I use a calculator for long-term projections, like 2030 or 2035?

Absolutely. Just input your buy price, time horizon, and future target price. While speculative, it helps visualize long-term growth and risk.

Do these tools include taxes?

Some advanced calculators offer tax estimation features based on your country or capital gains bracket. If not, consider pairing your calculator with tools like Koinly or CoinTracker.

Conclusion: Plan with Clarity, Trade with Confidence

A Bitcoin investment calculator is more than just a profit tool — it’s a confidence builder. It lets you simulate trades, test long-term scenarios, and approach your strategy with facts instead of emotions.

Whether you’re investing $100 or $10,000, seeing the numbers ahead of time helps you plan better, reduce risk, and trade with a clear head.

The crypto market is fast, emotional, and unpredictable. But tools like these bring structure to the chaos. If you’re serious about growing your portfolio, start running the numbers today — because smart investors don’t just guess, they calculate.

📌 Next Step: Try out a Bitcoin calculator, then explore our Crypto APY Calculator to project earnings from staking and DeFi strategies.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and you should always do your own research or consult a professional before making any financial decisions. Cryptocurrencies are volatile and involve significant risk of loss. Past performance is not indicative of future results.