Introduction: Uphold Isn’t Your Average Crypto App

- Uphold is a multi-asset trading platform offering access to cryptocurrencies, fiat currencies, precious metals, and U.S. equities.

- The platform is regulated and offers two-factor authentication and cold storage, but has faced past security issues that raised concerns.

- Uphold charges no explicit trading fees, but applies spreads ranging from 1.5% to 2.95%, which are often higher than competitors like Coinbase.

- New ACH deposits can trigger a 65-day withdrawal hold unless identity is fully verified or Plaid is used.

- The platform is not available in certain U.S. states, including New York and Hawaii.

Key Takeaways

- Uphold is a multi-asset trading platform offering access to cryptocurrencies, fiat currencies, precious metals, and U.S. equities.

- The platform is regulated and offers two-factor authentication and cold storage, but has faced past security issues that raised concerns.

- Uphold charges no explicit trading fees, but applies spreads ranging from 1.5% to 2.95%, which are often higher than competitors like Coinbase.

- New ACH deposits can trigger a 65-day withdrawal hold unless identity is fully verified or Plaid is used.

- The platform is not available in certain U.S. states, including New York and Hawaii.

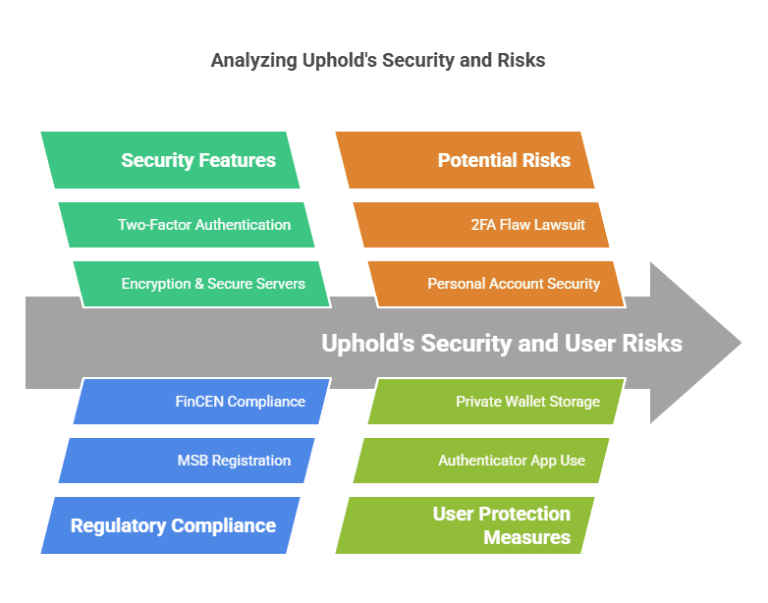

Is Uphold Safe to Use?

Uphold is a licensed and regulated platform that operates under U.S. and U.K. financial oversight, including registration with FinCEN in the United States and authorization by the FCA in the United Kingdom.

These regulatory credentials provide a basic level of compliance and transparency, especially when compared to unregulated offshore exchanges.

However, Uphold’s security history is mixed. While the company has implemented standard protections such as two-factor authentication (2FA) and cold storage for 90% of customer funds, it previously faced legal action related to alleged 2FA vulnerabilities.

In 2022, a class-action lawsuit claimed that hackers were able to bypass SMS-based 2FA and access user accounts. The company settled and subsequently upgraded its internal controls.

Security Features

- Mandatory 2FA for login and withdrawals

- Cold storage of digital assets to minimize exposure to online attacks

- Bug bounty program encouraging external security audits and vulnerability reports

Known Issues

- Past 2FA flaw, now reportedly fixed, raised concerns about the robustness of user-level protections

- Withdrawal holds on new accounts or unverified deposits can cause delays, particularly for first-time users

Best Practices for Using Uphold Safely

- Use an authenticator app (e.g., Google Authenticator or Authy) instead of SMS for 2FA

- Enable withdrawal whitelisting to restrict transfers to approved addresses

- Store long-term assets in cold wallets like Ledger or Trezor rather than leaving funds on the platform

While Uphold has taken visible steps to improve its infrastructure, users should still approach it with the same security mindset they’d apply to any centralized exchange: use strong personal protections, understand the limits of platform insurance, and avoid storing large balances online.

Uphold Fees Explained

Uphold does not charge traditional trading fees. Instead, it applies a spread-based pricing model, which means users pay the difference between the buy and sell price of each asset. These spreads are embedded in the quoted price at the time of the trade and vary depending on the asset class and market conditions.

Typical Spread Ranges

- Bitcoin (BTC), Ethereum (ETH): Approximately 1.5%

- Solana (SOL): Around 1.9%

- Precious Metals (e.g., Gold – XAU): Up to 2.95%

- Lower-liquidity crypto pairs: Can exceed 3% in volatile conditions

In comparison, exchanges like Coinbase often charge a flat 0.5% spread plus an additional transaction fee, which can sometimes result in lower total costs — especially for high-frequency or large-volume trades.

Why Uphold Feels More Expensive

- Spreads are non-transparent until the moment of trade, making it harder to predict total cost

- Exotic assets and fiat conversions (e.g., gold, GBP, or MXN transfers) carry higher spreads due to limited liquidity

- Instant debit withdrawals incur an additional 1.75% fee, while ACH bank transfers are generally free

How to Minimize Fees on Uphold

- Stick to high-volume pairs like BTC/USD or ETH/USD where spreads are lowest

- Avoid small, frequent trades that compound spread costs

- Use ACH or bank transfers instead of debit cards for funding or withdrawals

- Consolidate trades when converting multiple assets to avoid repeated spread hits

While Uphold’s fee structure is simple on the surface, it can be more expensive over time if you’re not aware of how spreads accumulate. Active traders and those moving large sums frequently may find better value on lower-spread platforms.

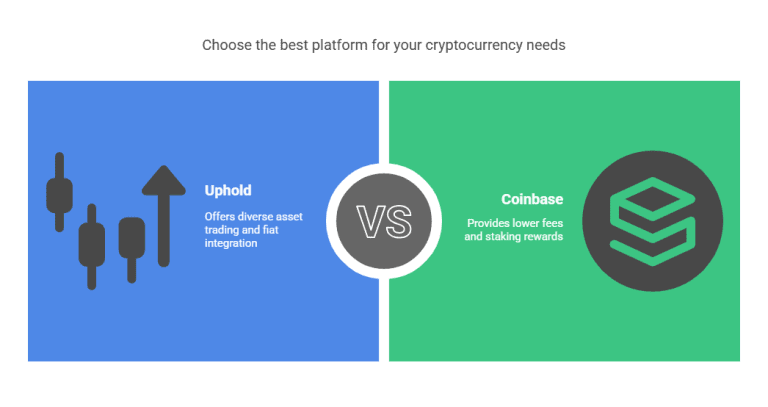

Uphold vs. Coinbase: Which Is Better?

Both Uphold and Coinbase are regulated U.S.-based platforms, but they serve very different user types. Choosing between them depends on what you’re looking for: multi-asset flexibility or low-cost crypto investing.

Feature Comparison

Feature | Uphold | Coinbase |

Asset Types | Crypto, fiat, U.S. stocks, precious metals | Crypto only |

Number of Cryptocurrencies | 250+ | 150+ |

Staking Rewards | Not available (U.S.) | Available on ETH, SOL, ADA, and more |

Fee Structure | No trading fee; 1.5%–2.95% spread | ~0.5% spread + 1% fee (varies by product) |

Security | 2FA, cold storage, regulated by FinCEN/FCA | 2FA, cold storage, $256M insurance fund |

Availability | Not available in NY, HI | Available in all U.S. states |

Withdrawal Speed | Slower for new users; ACH holds possible | Generally faster processing and fewer restrictions |

When Uphold Is the Better Fit

- You want to trade across multiple asset classes, including metals and fiat currencies

- You need cheap cross-border conversions for currencies like EUR, GBP, or MXN

- You prefer a simple interface without advanced trading tools

When Coinbase Is the Better Fit

- You’re focused on crypto-only investing and staking

- You trade frequently and want faster execution with more transparent pricing

- You live in New York or Hawaii, where Uphold is not available

Verdict: Uphold offers more flexibility across asset types, but at the cost of higher spreads and limited availability. Coinbase is better suited for crypto-focused users who value staking, speed, and lower transaction costs.

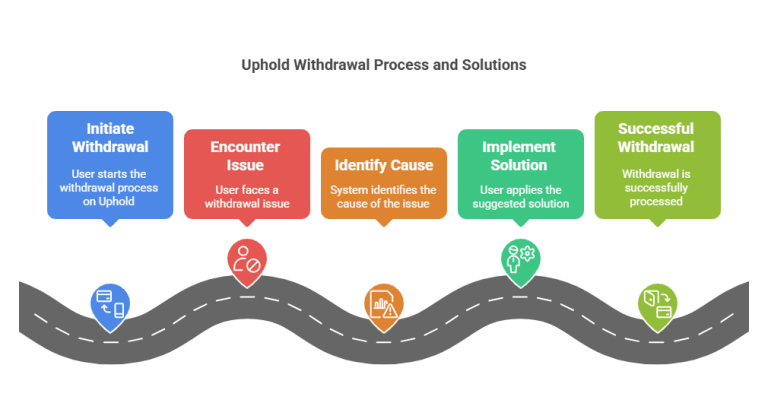

How Uphold Withdrawals Work

Uphold supports withdrawals to crypto wallets, bank accounts, and other fiat destinations, but the process can be slower and more restrictive than on platforms like Coinbase or Kraken — particularly for new users or recently funded accounts.

Common Withdrawal Issues and How to Avoid Them

1. 65-Day Withdrawal Hold

Cause: ACH bank deposits made without instant account verification

Impact: Funds are locked from withdrawal for up to 65 days

Solution:

Use Plaid for instant account linking

Complete full identity verification before trading

Fund via debit card or wire transfer if speed is critical

2. Crypto Withdrawal Delays

Cause: New users or accounts with recent activity may be flagged for additional review

Impact: Crypto transfers can be delayed for security reasons

Solution:

Verify your identity early (ID, selfie, address)

Add and whitelist withdrawal addresses in advance

Avoid withdrawing large amounts before completing all compliance steps

3. Slow Bank Transfers

Cause: Compliance checks for larger fiat withdrawals or foreign currency conversions

Impact: Delays in receiving funds, especially for sums over $1,000

Solution:

Break large transfers into smaller amounts

Use stablecoin withdrawals (like USDT or USDC) for faster settlement

Additional Tips

Uphold processes withdrawals on business days, so delays over weekends are common

Crypto gas fees may vary — sending late at night or during low traffic can reduce costs

Always double-check your destination address before confirming any transfer

While Uphold supports a wide range of withdrawal options, the platform’s conservative compliance approach means first-time users may face delays or unexpected restrictions. Planning ahead can help avoid frustration.

Frequently Asked Questions About Uphold

Is my money FDIC-insured on Uphold?

Only U.S. dollar cash balances held through Uphold’s partner banks are eligible for FDIC insurance, up to $250,000. Cryptocurrency, precious metals, and other digital assets are not covered.

Does Uphold report to the IRS?

Yes. Uphold is required to report user activity to the IRS when certain thresholds are met. If you complete more than 200 transactions or exceed $20,000 in volume, you’ll receive a 1099-B tax form.

Can I stake crypto on Uphold?

Staking is not currently supported for U.S. users due to regulatory restrictions. Users in select non-U.S. jurisdictions may have access to staking on supported assets.

Is Uphold a crypto wallet or an exchange?

It functions as both. Uphold is a custodial platform that offers wallet services and exchange functionality. Users can buy, sell, hold, and withdraw crypto — but it is not a self-custody solution.

Is Uphold available in every U.S. state?

No. As of 2025, Uphold is not available in New York, Hawaii, and a few other restricted jurisdictions. Availability may change based on evolving regulatory compliance.

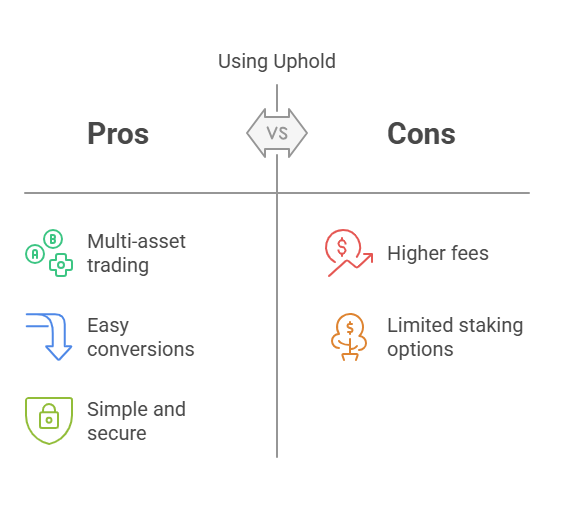

Conclusion: Who Should (and Shouldn’t) Use Uphold

Uphold is a versatile platform for users who want access to more than just crypto. If you’re looking for a simple way to manage digital assets, fiat currencies, metals, and even U.S. stocks in one place, Uphold delivers convenience that few competitors offer.

It’s best suited for:

- Casual investors who want exposure to multiple asset types without juggling multiple platforms

- Global users needing low-cost conversions between currencies like USD, EUR, GBP, and MXN

- First-time crypto users who prefer simplicity over advanced trading features

However, Uphold is not ideal for:

- Active traders who need fast execution and minimal fees — spreads will eat into returns

- Users in restricted states like New York or Hawaii

- Investors focused on staking or DeFi — Uphold doesn’t offer these features for U.S. accounts

If you’re unsure, consider starting with a small deposit, explore the interface, and compare costs before committing larger amounts. Uphold isn’t for everyone — but for certain users, its multi-asset flexibility and regulatory transparency offer real value.

NEXT: Explore our full beginner’s guide to cryptocurrency.