Introduction

Investing regularly over time is one of the simplest ways to build discipline—and potentially, long-term growth. That’s exactly what a Systematic Investment Plan (SIP) is designed to support: steady contributions, invested consistently, without needing to time the market.

But as your money goes in month after month, a common question arises: “What will this look like in 5, 10, or 20 years?”

That’s where an SIP calculator becomes a useful tool. It helps you visualize how your investments may grow based on the amount you invest, how long you stay invested, and the returns you assume.

This guide explains how SIP calculators work, how to use them effectively, and what to keep in mind as you plan your long-term strategy.

Whether you’re investing for retirement, a major purchase, or just building a financial habit, understanding how SIPs grow over time is a valuable starting point.

Key Takeaways

- SIP calculators help estimate the future value of regular investments using factors like contribution amount, investment duration, and assumed return rates.

- These tools show potential growth using compound interest, giving a clearer picture of how consistent investing can add up over time.

- Most calculators require just a few inputs: your monthly investment, expected annual return, and the number of years you’ll stay invested.

- Advanced tools may also factor in taxes or inflation, offering more realistic estimates.

- Results are projections—not promises—and should be used for planning, not predicting exact outcomes.

What Is an SIP?

A Systematic Investment Plan (SIP) is a method of investing where you contribute a fixed amount into a financial instrument—usually a mutual fund—at regular intervals, most commonly monthly.

Rather than investing a large lump sum all at once, SIPs allow you to spread your investment over time. This approach not only encourages financial discipline, but also helps reduce exposure to market volatility through what’s known as rupee-cost averaging (or dollar-cost averaging, depending on your currency).

Here’s how it works in simple terms:

- You decide how much you want to invest each month.

- That amount is automatically invested at scheduled intervals.

- Over time, you accumulate more units when prices are low and fewer when prices are high—averaging your overall cost per unit.

SIPs are widely used by long-term investors who prefer consistency and want to stay invested regardless of short-term market fluctuations.

They don’t guarantee returns, and they don’t remove risk—but they do provide a structured, manageable way to build an investment habit over time.

What Is an SIP Calculator?

An SIP calculator is a digital tool that helps you estimate how much your recurring investments could grow over a specific period of time. It does this by applying a compound interest formula to your regular contributions.

Rather than trying to calculate everything manually—or guess how much you’ll end up with—you simply enter:

- Your monthly investment amount

- The number of years you plan to invest

- The annual rate of return you expect

The calculator then estimates your maturity value—that is, the total amount your investments might be worth by the end of your chosen timeframe.

Some tools go further by including options for:

- Inflation adjustment to reflect future purchasing power

- Tax assumptions based on fund type (equity, debt, ELSS)

- Step-up options to simulate increasing your contributions over time

It’s important to remember that SIP calculators show projections based on assumptions. They don’t predict future returns or guarantee outcomes. But they are useful for visualizing long-term scenarios and making more informed planning decisions.

How SIP Calculators Work (Without the Hype)

At the heart of every SIP calculator is a standard formula based on compound interest. It’s designed to estimate how your monthly contributions might grow over time—assuming a fixed rate of return and regular investments.

Here’s the general formula most SIP calculators use:

Final Value = P × [(1 + r)<sup>n</sup> – 1] / r × (1 + r)

Where:

- P = your monthly investment

- r = monthly interest rate (annual return ÷ 12)

- n = total number of investment months (years × 12)

📘 Example (No Currency):

Let’s say you’re investing monthly for 10 years at an assumed return of 10% annually.

- Monthly Investment: 200

- Expected Annual Return: 10%

- Monthly Return (r): 10% ÷ 12 = 0.0083

- Investment Period (n): 10 years × 12 = 120 months

Using the calculator, you’d see an estimated maturity value based on those inputs.

Keep in mind:

- The calculator assumes consistent contributions

- It doesn’t account for taxes, platform fees, or market fluctuations unless specified

- The actual results may vary depending on investment performance

Think of the calculator as a planning tool, not a performance forecast. It helps you set expectations, compare scenarios, and make better long-term decisions—not predict exact outcomes.

Step-by-Step: How to Use an SIP Calculator

An SIP calculator helps turn vague investment ideas into concrete, measurable plans. Once you get the hang of it, you can quickly test different strategies and timelines to see what fits your goals.

Here’s how to use one effectively:

1. Choose a Trusted Calculator Tool

Start by selecting a reliable SIP calculator. Many are free to use and available on investment platforms, financial planning sites, or banking portals. Some calculators are basic, while others include advanced options like inflation or tax adjustments. Choose one that matches your comfort level.

2. Enter Your Monthly Investment Amount

Input the amount you plan to invest regularly. This could be $100, $500, or any other amount that fits your budget. Even small amounts invested consistently can add up over time due to compounding.

If you’re unsure how much to start with, try entering a few different amounts and comparing results to find a contribution that feels realistic.

3. Set Your Investment Duration

Choose the length of time you plan to keep investing—typically anywhere from 5 to 30 years. The longer the duration, the greater the potential impact of compounding. Many calculators will display the result in both years and total months.

Pro tip: Use longer durations to see the full effect of consistency over time.

4. Input an Assumed Rate of Return

This is where you estimate how much your investment might grow each year. Use a conservative number if you’re unsure.

- Equity funds might show historical returns between 10–12%

- Debt-based funds typically return less (around 6–8%)

You’re not predicting the future here—you’re testing possibilities.

5. Adjust for Inflation or Taxes (If Available)

If the calculator allows, add inflation and tax inputs to see a more realistic view of your purchasing power. This step is optional, but highly recommended for longer-term planning.

6. Review Your Results

Once you’ve entered your inputs, the calculator will estimate:

- Your total invested amount

- Projected maturity value

- Estimated gains or earnings

This result gives you a clear snapshot of what your investment could grow into under the assumptions you’ve chosen.

Use it as a planning tool—not a prediction—and revisit it often as your goals, income, or market conditions change. The more you experiment, the more confident you’ll feel in your investment approach.

📊 How SIP Calculators Help with Planning

A calculator can’t predict the future—but it can help you plan for it more clearly.

That’s the real strength of an SIP calculator: it takes your current intentions (how much you want to invest, how long, and at what return) and shows you a projected outcome. With that visual in front of you, it becomes easier to set goals, adjust strategies, and stay consistent.

Here’s how it supports better decision-making:

🔍 Clarity in Numbers

Instead of vague guesses like “I’ll just invest for a while,” a calculator tells you:

“If I invest $300 per month for 15 years at 9%, I could end up with approximately [projected amount].”

That makes long-term thinking feel more tangible—and manageable.

📅 Goal Setting That’s Grounded in Reality

Whether you’re saving for education, retirement, or a future purchase, the calculator shows whether your current plan is likely to get you there—or if you might need to adjust the timeline, monthly amount, or expectations.

🔄 Scenario Testing

Try out “what if” experiments:

- What if I invested for 5 more years?

- What if I doubled my contributions in year 10?

- What happens if I drop the expected return rate to 7% instead of 10%?

These small changes can make a big difference over time—and the calculator helps you see it instantly.

📈 Reinforcing Consistency

SIP investing is all about staying consistent. Having a clear view of your progress—even if it’s just a projection—can keep you motivated to stick with the plan during market ups and downs.

Whether you’re just starting out or fine-tuning your investment strategy, an SIP calculator doesn’t just show you numbers. It helps you see the plan—and that clarity is what builds confidence over time.

⚠️ Limitations and What to Watch Out For

SIP calculators are helpful for visualizing investment growth, but they aren’t crystal balls.

They’re built on formulas and assumptions, which means the numbers you see are projections—not promises. If you’re going to use one effectively, it’s important to understand what it can and can’t do.

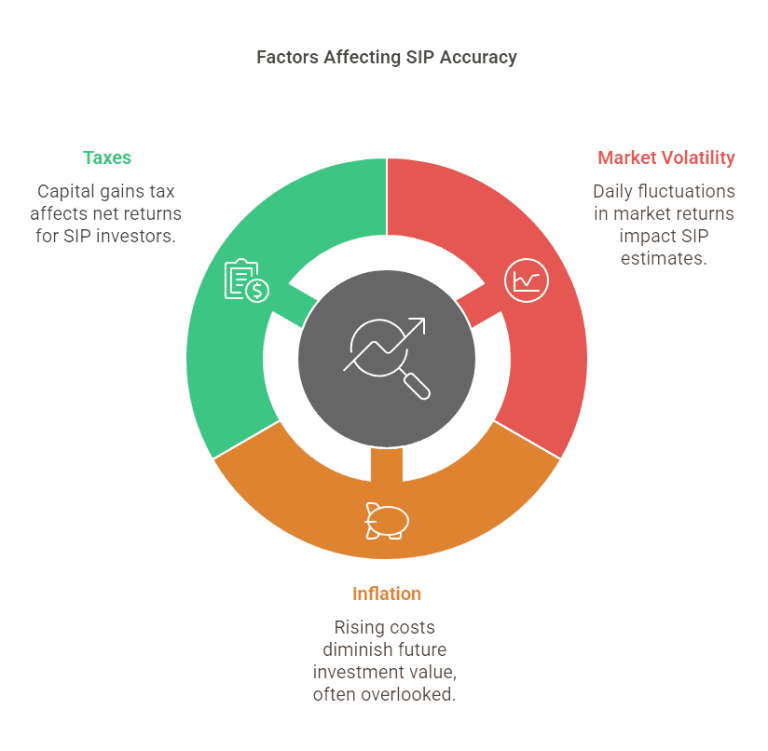

🌀 Market Performance Isn’t Fixed

Most calculators ask for an expected annual return, but in reality, returns can vary widely year to year. Markets go through highs and lows, and past performance doesn’t guarantee future results.

What you input as a “return rate” is just a guess—one that should be made carefully, and conservatively when possible.

💸 Taxes and Fees Aren’t Always Included

Unless you’re using a calculator that specifically adjusts for taxes or fund management fees, your projections may be on the optimistic side. Real-world returns often get reduced by:

- Long-term or short-term capital gains tax

- Expense ratios on mutual funds

- Platform or transaction fees

If these aren’t factored in, your maturity value could look higher than what you’d actually receive.

📉 Inflation Changes the Value of Money

Even if your SIP grows consistently, the purchasing power of that final amount might be lower than expected—especially over 10, 20, or 30 years.

Some advanced calculators allow you to input an inflation rate to adjust your results, giving a more realistic sense of how far your investment might stretch in the future.

🧠 Calculators Don’t Know Your Goals

These tools are great for numbers—but they can’t decide if your plan fits your financial needs, risk tolerance, or long-term objectives. For that, it’s helpful to review your strategy periodically and consider other factors beyond the numbers on screen.

An SIP calculator is a planning assistant—not a financial advisor, and not a prediction engine. Used wisely, it helps you stay informed and intentional. But it should always be paired with broader thinking and periodic review.

🧰 Choosing the Right SIP Calculator Tool

SIP calculators provide estimates, not guarantees. Accuracy depends on:

Not all SIP calculators offer the same features. Some are designed for simplicity, while others include advanced settings like tax impact, inflation adjustments, or step-up contributions.

Choosing the right tool depends on your comfort level, your goals, and how detailed you want your projections to be.

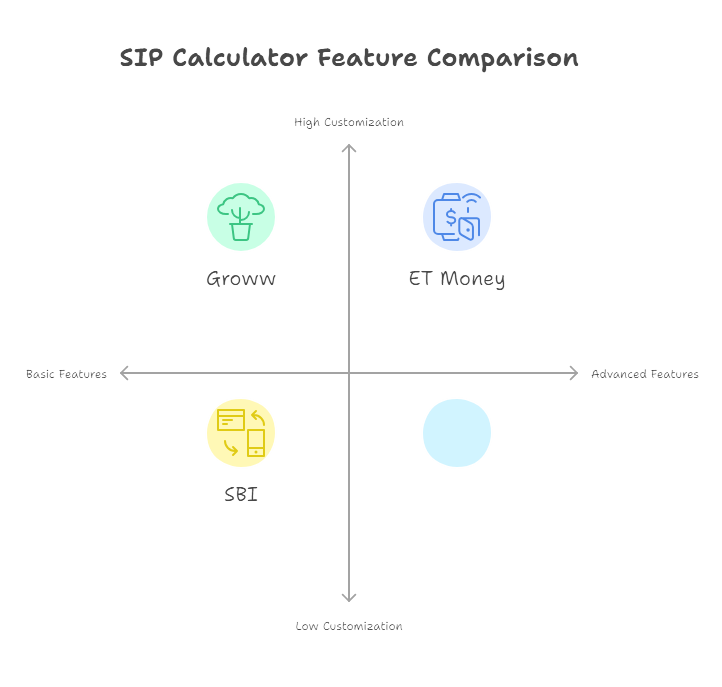

Here’s a comparison of some of the most widely used SIP calculators:

Platform | Best For | Key Features |

Groww | Beginners | Simple interface, easy to use, quick results |

ET Money | Advanced planners | Includes tax adjustment, inflation toggle, step-up SIP |

ClearTax | Tax-focused users | ELSS benefits, LTCG/STCG tax impact visualized |

SBI / HDFC | Conservative investors | Bank-backed tools, basic output, minimal distractions |

What to Look For in a Good Calculator:

- Clear breakdown of total invested vs. projected value

- Option to adjust for compounding frequency

- Ability to simulate different scenarios easily

- Optional inputs for tax, inflation, or annual investment increase

If you’re just starting out, a simple calculator might be enough. But if you’re making long-term decisions, or factoring in future income growth or tax liabilities, using a more advanced tool can give you a clearer picture.

⚖️ SIP vs Lumpsum: When to Use Each Approach

Both SIPs and lumpsum investments are common strategies—but they serve different purposes depending on your financial situation, risk tolerance, and timing.

Let’s look at how they compare:

Aspect | SIP (Systematic Investment Plan) | Lumpsum Investment |

Investment Style | Recurring, disciplined | One-time, large amount |

Market Risk | Lower (averages out entry points) | Higher (timing matters more) |

Convenience | Easier for budgeting and income-based saving | Requires significant upfront capital |

Volatility Impact | Smoother, due to regular investment cadence | Exposed to immediate market movement |

Best Suited For | Long-term planners, salary-based investors | Investors with idle funds and higher risk tolerance |

When SIP May Be a Better Fit:

- You prefer consistency over market timing

- Your income is monthly or variable

- You want to stay invested through market cycles

When Lumpsum Might Make Sense:

- You’ve received a bonus, inheritance, or large payout

- Market conditions align with your risk outlook

- You’re comfortable handling volatility upfront

Neither approach is “better” across the board. Many long-term investors even use both: a consistent SIP for steady growth, and occasional lumpsum investments when the opportunity aligns.

To learn more about SIP vs Lumpsum go here.

Top SIP Calculators in 2025

| Platform | Key Features | Best For |

|---|---|---|

| Groww | Step-up SIPs, user-friendly | Beginners |

| SBI | Tax-saving SIP modes | Conservative investors |

| HDFC | Historical fund performance | Long-term planners |

| ET Money | Inflation-adjusted projections | Advanced users |

Note: Compare tools on Moneycontrol or Value Research.

❓ Frequently Asked Questions (FAQs)

1. What’s the difference between an SIP and a mutual fund?

An SIP is a method of investing, while a mutual fund is a financial product. You can invest in a mutual fund either through a one-time lumpsum or by setting up an SIP to contribute regularly.

2. Can an SIP calculator guarantee returns?

No. SIP calculators provide estimates based on assumed return rates. The actual performance of your investment depends on market conditions and other factors such as fees or taxes.

3. What return rate should I use in an SIP calculator?

There’s no fixed answer. Many calculators allow you to test different scenarios. You might choose a conservative average based on historical fund data, but it’s best to explore multiple possibilities.

4. Do SIP calculators account for inflation or taxes?

Some advanced tools do. Basic calculators typically show gross returns. If you’re planning over a long duration, using a calculator that includes inflation and tax adjustments can provide a more realistic projection.

5. Are SIPs only for beginners?

Not at all. SIPs are used by new and experienced investors alike. They’re valued for their structure and consistency, especially for long-term investment goals.

🧾 Conclusion: A Smarter Way to Plan, Not Predict

Investing through an SIP is a long-term decision—and understanding how your contributions might grow over time can make that journey more intentional.

SIP calculators won’t tell you what the market will do. But they will help you visualize how consistent investing, compounded over time, can shape your financial roadmap.

Whether you’re saving for a future goal or simply building better financial habits, these tools can turn abstract ideas into something tangible—while helping you test, compare, and refine your plan.

🔗 Ready to explore your options?

Use our Calculator here to see how your investments could take shape—one contribution at a time.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and you should always do your own research or consult a professional before making any financial decisions. Cryptocurrencies are volatile and involve significant risk of loss. Past performance is not indicative of future results.