Introduction

A step-up SIP is designed for how real life works: your income increases, and so should your investments.

Instead of contributing the same amount every month for years, a step-up SIP lets you increase your monthly investment annually—often by 5% to 15%. That small adjustment can make a significant difference over time.

But how much of a difference?

That’s where a step-up SIP calculator comes in. It lets you simulate the growth of your investments when your contributions rise each year, showing how compounding responds to even modest increases.

Whether you’re planning around future salary hikes or simply want your SIP to scale with your goals, this tool helps you visualize what’s possible—before you commit.

Key Takeaways

- A step-up SIP increases your investment amount every year by a fixed percentage (e.g., +10% annually).

- A step-up SIP calculator helps estimate how that growing contribution impacts long-term investment projections.

- It’s ideal for planning as your income rises, and for setting more aggressive but achievable financial goals.

- Most calculators ask for: initial investment, step-up rate, duration, and expected return.

- If your tool doesn’t support step-up inputs directly, you can simulate it manually using a standard SIP calculator in phases.

📈 What Is a Step-Up SIP?

A step-up SIP is a variation of a Systematic Investment Plan where your monthly contribution increases automatically each year by a fixed percentage.

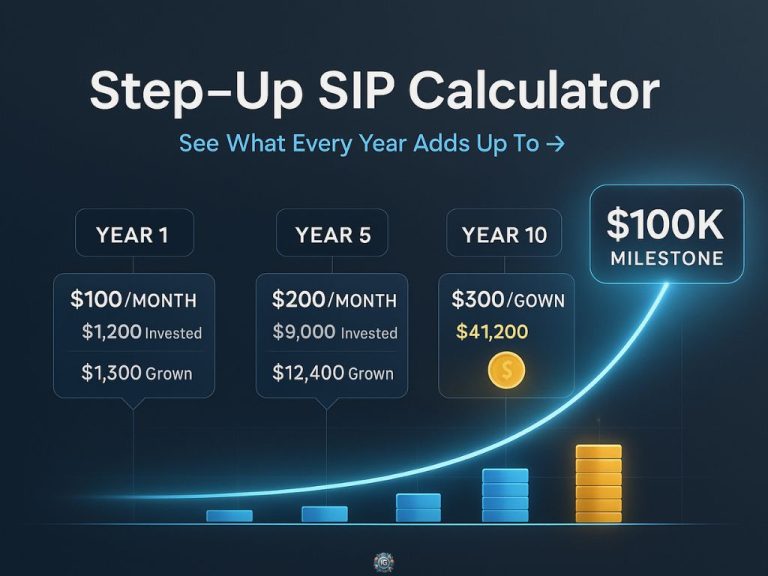

Instead of investing the same amount every month, you scale your SIPs gradually. For example:

- Year 1: $200/month

- Year 2: $220/month (+10%)

- Year 3: $242/month (+10%), and so on

This approach mirrors how most people earn—your income tends to grow over time, and your investments can grow with it.

🔹 Why It Exists

The idea behind a step-up SIP is to:

- Take advantage of income increases

- Offset inflation

- Accelerate long-term financial goals without feeling the burden upfront

It’s especially popular with salaried professionals, long-term investors, or anyone planning for major milestones like retirement, education, or home buying.

Instead of trying to “catch up” later in life, a step-up SIP allows you to scale with

🧮 Why Use a Step-Up SIP Calculator?

A step-up SIP calculator helps you answer one of the most important planning questions:

“What happens if I increase my investment every year?”

It’s easy to underestimate how powerful small, consistent increases can be—especially when compounded over 10, 15, or 25 years. A step-up SIP calculator turns that long-term picture into something visual, measurable, and actionable.

🔍 What It Helps You Do:

- Visualize future growth: See how contributions + compounding work together

- Plan smarter: Align your SIPs with projected income growth

- Set realistic targets: Test different step-up rates (5%, 10%, 15%) to find what fits

- Compare strategies: Understand how a step-up SIP differs from a fixed SIP—and what that means for your goals

Even a small annual increase—like 5%—can have a noticeable effect on your projected maturity value over time. This calculator gives you a way to simulate that impact clearly and confidently.

⚙️ How a Step-Up SIP Calculator Works

A step-up SIP calculator takes the concept of increasing monthly investments and translates it into long-term projections using compound interest.

Instead of assuming a fixed monthly contribution, the calculator models a scenario where your SIP amount grows by a fixed percentage every year. This simulates how real-world investing often works when income and savings potential improve over time.

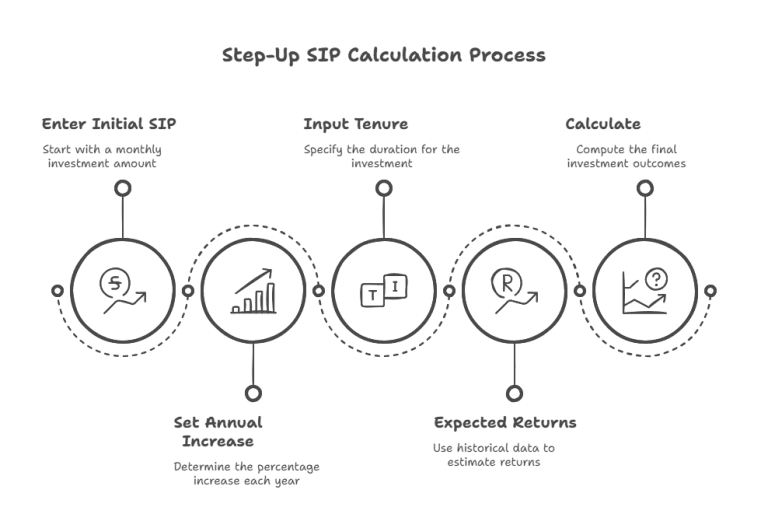

🔢 What You’ll Typically Input:

- Initial Monthly Investment — your starting contribution

- Annual Step-Up Percentage — the rate at which you want to increase your SIP (e.g., +10% yearly)

- Investment Duration — how long you plan to continue the SIP (in years)

Expected Annual Return — the assumed average return from your investment (based on past performance or planning assumptions)

📊 What the Calculator Outputs:

- Total Invested Amount — the sum of all your contributions over the chosen period

- Projected Maturity Value — the estimated future value based on compounding

- Estimated Interest Earned — the difference between what you invested and what it could grow to

- Optional Breakdown — some tools may include charts, annual summaries, or step-up milestones

By changing any input—such as the step-up rate or duration—you can immediately see how that affects your end goal. This makes it a powerful tool for planning around future salary growth, budgeting increases, or long-term financial targets.

🧭 Step-by-Step: How to Use a Step-Up SIP Calculator

Using a step-up SIP calculator is simple, but the insights it provides can be surprisingly powerful. Here’s how to make the most of it:

1. Enter Your Initial Monthly Investment

Start with the amount you’re currently contributing or are comfortable starting with. This is your base SIP amount for year one.

2. Set Your Annual Step-Up Rate

Choose how much you’d like your SIP to increase every year. Common step-up rates are 5%, 10%, or 15%. Choose a percentage that realistically matches your expected income growth.

3. Choose Your Investment Duration

Select how long you plan to continue the SIP. Most investors choose 10 to 30 years, depending on their financial goals.

4. Enter the Expected Annual Return

This is your assumed return rate. While the actual rate will vary based on market performance, many investors use historical averages—typically around 10–12% for equity-based SIPs, and lower for debt instruments.

5. Review the Results

The calculator will show you:

- Your total investment over the full period

- The projected maturity value

- The interest earned through compounding

- (If available) visual charts showing how your contributions and returns grow over time

Try adjusting the step-up rate or return assumption to compare different scenarios. A small change can significantly affect long-term results—especially when combined with compounding.

🔄 Step-Up SIP vs Regular SIP

Both regular SIPs and step-up SIPs follow the same core principle: investing consistently over time. The difference lies in how your contributions behave—and how aggressively your investment can grow when contributions increase annually.

Here’s a breakdown:

Feature | Regular SIP | Step-Up SIP |

Monthly Investment | Fixed for the entire duration | Increases annually by a fixed percentage |

Contribution Style | Static | Dynamic and scalable |

Best For | Stable income or conservative goals | Salaried growth, long-term compounding |

Planning Flexibility | Simple and consistent | Customizable with income progression |

Growth Potential | Moderate | Higher due to increasing principal |

📘 Key Insight:

A step-up SIP doesn’t just rely on market performance—it amplifies your returns by increasing how much you’re investing. That layered growth can help bridge the gap between today’s budget and tomorrow’s financial goals.

Regular SIPs are great for simplicity. But if you expect your income to rise steadily over time, a step-up SIP may be the smarter way to align your contributions with your capabilities.

🔧 Simulating a Step-Up SIP with a Regular Calculator

If you don’t have a dedicated step-up SIP calculator (yet), you can still estimate how increasing contributions might impact your long-term investments—by breaking it into parts.

This manual method takes a little more effort, but it works.

🔁 Here's How to Do It:

- Split your investment duration into blocks

Example: If you plan to invest for 15 years, break it into 3 blocks of 5 years each.

- Set a starting SIP amount for block one

Use a base monthly investment (e.g., $200 for years 1–5).

- Increase the SIP amount for each block

Apply your annual step-up rate. For 10%, the second block might be $322/month (after compounding yearly increases), and so on.

- Run each block separately using a regular SIP calculator

Input:

- Monthly contribution for that block

- Duration of that block

- Expected return

- Add up the projected maturity values from all blocks

This gives you an approximate picture of what a full step-up SIP would look like.

📌 Example:

- Years 1–5 at $200/month → Projected value A

- Years 6–10 at $322/month → Projected value B

- Years 11–15 at $518/month → Projected value C

- Estimated total maturity value = A + B + C

This method doesn’t offer perfect precision—but it gives you a close approximation until your dedicated step-up SIP calculator is ready.

⚠️ Limitations to Be Aware Of

Step-up SIP calculators are incredibly helpful when you’re planning long-term investments — but they aren’t crystal balls. Like any projection tool, they operate on assumptions, not certainties. Knowing their limitations can help you use them more effectively and avoid misleading expectations.

Here’s what you need to be aware of:

🔹 1. Projections Depend on Assumed Returns

The calculator asks you to enter an expected annual return (e.g., 10%). But in reality, market performance is never linear. Some years will overperform, others will underperform — and the average may differ from what you expected.

The tool helps you visualize a possible outcome, but not the only one.

🔹 2. Taxes and Fees Are Often Left Out

Unless you’re using a tax-adjusted calculator, the maturity value shown doesn’t account for:

- Long-term capital gains tax (which applies to most equity SIPs)

- Fund management expenses (expense ratios)

- Platform or transaction fees

These can have a meaningful impact on your net returns, especially in higher-value portfolios.

🔹 3. Inflation Reduces Future Value

A projected corpus of $200,000 might seem like a big win — until you factor in 15–20 years of inflation. Many calculators show absolute figures, but not what that money will be worth in future purchasing power.

If inflation isn’t factored in, your plan might look more successful on paper than it actually is.

🔹 4. Manual Simulations Can Introduce Errors

If you’re using a regular SIP calculator to simulate step-up behavior (by breaking down into chunks), there’s room for miscalculations. You might:

- Use the wrong compounding frequency

- Apply the step-up rate inconsistently

- Forget to align time periods correctly

It’s still a useful method — but not as precise as a purpose-built step-up calculator.

🔹 5. Life Doesn’t Always Follow the Plan

Calculators assume consistency: that you’ll make every monthly investment on time, increase contributions yearly, and stay the course for decades. But in real life, income disruptions, unexpected expenses, or behavioral changes can derail even the best-laid financial plans.

The tool gives you a map. But you still have to steer through changing weather.

🧠 Bottom Line:

Use a step-up SIP calculator to plan smarter, not predict perfectly. When combined with self-discipline and periodic review, it’s one of the most powerful tools available for long-term goal setting.

🧪 Try Our SIP Calculator

Curious how your investment might grow if you increased your contributions over time?

While our current SIP calculator supports fixed monthly inputs, you can still use it to simulate a step-up SIP by breaking your plan into blocks and running multiple scenarios. It’s a practical way to get started—even before a dedicated step-up calculator is available.

Test out your starting monthly investment, expected return, and duration. Then adjust those inputs to reflect your planned increases and compare the projections. It’s a quick way to build confidence in your plan and take the first step toward smarter long-term investing.

❓ Frequently Asked Questions (FAQs)

1. What is a step-up SIP calculator?

A step-up SIP calculator is a tool that helps you estimate the future value of your investment when you increase your monthly SIP contribution by a fixed percentage each year. It accounts for both compounding and contribution growth over time.

2. How does a step-up SIP differ from a regular SIP?

A regular SIP keeps your monthly contribution fixed throughout the investment period. A step-up SIP increases your contribution annually, allowing you to invest more over time—often aligned with salary growth or inflation.

3. What is a good step-up rate to use?

There’s no one-size-fits-all answer, but many investors start with a 10% annual increase. The right rate depends on your income growth, financial goals, and budget flexibility.

4. Can I simulate a step-up SIP using a regular SIP calculator?

Yes. While it requires manual effort, you can divide your investment period into segments and increase the SIP amount in each phase. Add the projections from each segment to estimate the total outcome.

5. Are step-up SIPs more effective than regular SIPs?

They can be—if your income is growing and you can afford to increase contributions over time. Step-up SIPs take advantage of compounding on a larger base, potentially accelerating your wealth-building path.

🧾 Conclusion: Let Your Investments Scale With You

Planning your future with a fixed monthly investment is a good start. But planning for a future where your contributions grow—just like your income—can be a smarter move.

A step-up SIP strategy lets you increase your investment commitment year after year, aligning your financial plan with real-life progress. And with the right calculator, you can visualize how those incremental increases translate into long-term growth.

Whether you’re using a standard SIP calculator for now or waiting for a step-up-ready version, the important thing is this: you’re thinking ahead, and you’re building a plan designed to evolve with you.

Test your numbers. Simulate your strategy. And get one step closer to financial clarity—starting today.

Discover How to Maximize Returns with Our SIP Calculator Guide– Start Here.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and you should always do your own research or consult a professional before making any financial decisions. Cryptocurrencies are volatile and involve significant risk of loss. Past performance is not indicative of future results.

1 thought on “Step-Up SIP Calculator: See What Annual Increases Can Do”

Comments are closed.