Introduction

When it comes to long-term investing, two strategies dominate the conversation: Systematic Investment Plans (SIPs) and lumpsum investments.

Both have their strengths. Both have limitations. And neither is “better” in a vacuum.

The real question isn’t which one performs best on paper—it’s which one fits your income flow, mindset, and market perspective.

This guide breaks down the key differences between SIPs and lumpsum investing: how they work, how they respond to market conditions, and what type of investor each is best suited for.

No hype. No guesswork. Just a clear, side-by-side comparison to help you make smarter, more confident decisions.

Key Takeaways

- SIP (Systematic Investment Plan) involves investing smaller amounts at regular intervals, promoting consistency and reducing the impact of market volatility through cost averaging.

- Lumpsum investing means deploying a large amount of capital all at once, which can maximize gains during rising markets but also exposes the entire amount to immediate market risk.

- SIPs are well-suited for investors with recurring income and long-term goals, while lumpsum strategies work best when you have surplus capital and a strong view on market timing.

- Market conditions, risk tolerance, cash flow, and behavioral discipline all play a role in deciding which strategy is more appropriate.

- There’s no one-size-fits-all approach—many investors use a combination of both methods to align with different financial goals and life stages.

📉 SIP vs Lumpsum: Market Behavior and Timing Sensitivity

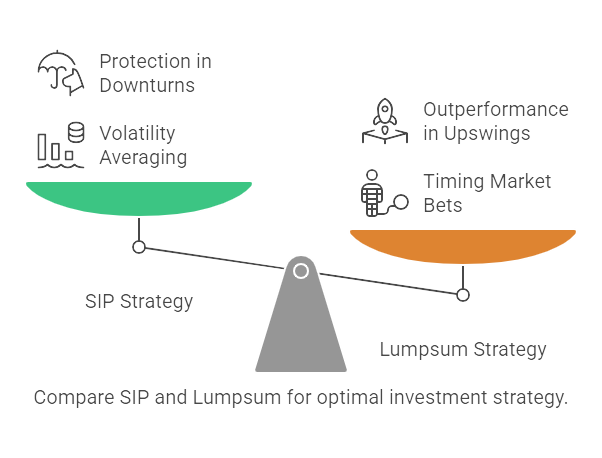

Market timing can make or break a lumpsum investment. With SIPs, the impact of timing is smoothed out over months or years.

That’s the core difference.

🔹 SIP: Built to Withstand Volatility

SIPs operate on a principle known as rupee cost averaging (or dollar cost averaging). You invest a fixed amount at regular intervals—meaning you automatically buy more units when prices are low, and fewer when prices are high.

Over time, this helps reduce the average cost per unit. You’re never trying to “time the bottom,” you’re just consistently buying through all phases of the market cycle.

This makes SIPs inherently more resistant to short-term volatility.

🔹 Lumpsum: High Risk, High Timing Exposure

With a lumpsum investment, your entire capital is exposed to market conditions the moment you invest. If markets rise afterward, you benefit fully. But if they dip—even temporarily—your portfolio reflects that loss immediately.

This approach amplifies both risk and reward, making it more sensitive to short-term fluctuations and entry points.

For example:

- Investing a lumpsum just before a market correction can delay growth for years.

- Investing just after a correction can significantly boost long-term returns.

That’s why many investors find lumpsum investing mentally harder—it forces them to confront market volatility upfront.

🧠 Bottom Line:

- SIPs dampen the impact of timing by spreading exposure over time.

- Lumpsum investing magnifies the impact of timing—for better or worse.

- Your comfort with market swings should play a major role in how you allocate capital.

🧠 Psychological Fit: Discipline vs Timing Pressure

Choosing between SIP and lumpsum isn’t just about math—it’s about mindset.

How you react to market volatility, uncertainty, and financial decisions under pressure plays a huge role in which strategy is more sustainable for you.

🔹 SIP: Built for Consistency, Not Conviction

SIPs are structured to remove emotion from the equation. Once you set it up, it runs automatically. You don’t need to make repeated decisions. You don’t need to watch the market. What you do is invest.

This is why SIPs work so well for people who:

- Want structure and habit

- Don’t have time to track markets

- Prefer a “set it and forget it” approach

The discipline is in showing up every month, not predicting the right moment.

🔹 Lumpsum: Requires Confidence and Conviction

Lumpsum investing is a high-commitment move. It assumes you’ve assessed the market and are comfortable putting all your capital to work in one go.

That means it’s better suited for investors who:

- Have done their research

- Can tolerate short-term losses

- Have a strong opinion on market timing or valuation

There’s no automation. No averaging. Just one big decision—and the consequences that follow.

For many, that’s too much mental pressure.

🧩 Which Fits You?

- Do you second-guess yourself after a dip?

- Do you feel anxious when prices fall?

- Are you disciplined enough to stay invested through noise?

If you lean toward long-term consistency and automation, SIPs align naturally.

If you’re analytical, confident in your timing, and can handle volatility, lumpsum investing may feel more intuitive.

SIP vs Lumpsum: Liquidity, Cash Flow, and Investor Profiles

Sometimes the decision between SIP and lumpsum isn’t strategic — it’s situational. What matters just as much as market conditions is how money flows in and out of your life.

How you receive income, manage expenses, and handle cash reserves will influence which investment style fits your reality.

🔹 SIP: Ideal for Recurring Income

If your income arrives steadily—like a monthly salary—SIPs are a natural fit.

They allow you to:

- Commit a manageable amount every month

- Avoid disrupting your daily budget

- Grow investments without requiring a large upfront contribution

This makes SIPs especially appealing for:

- Salaried professionals

- Freelancers with stable monthly income

- First-time investors who want to start small and build over time

It’s less about the amount and more about the rhythm.

🔹 Lumpsum: Suited for Windfalls and Idle Capital

Lumpsum investing is rarely a monthly decision—it’s often triggered by a financial event.

It works best when you:

- Receive a bonus, inheritance, or sale proceeds

- Have unallocated capital sitting in a savings account

- Want to shift large funds from low-return assets to long-term investments

It’s an efficient way to put surplus capital to work, provided you’re comfortable with the market timing risk.

🧭 Real-World Fit

Profile | Best Fit |

Monthly salary | SIP |

Year-end bonus | Lumpsum |

Sold real estate | Lumpsum |

Building wealth slowly | SIP |

Already sitting on $50k+ idle | Lumpsum or Hybrid |

Your cash flow isn’t just a background detail—it’s a major factor in choosing a method you can actually stick with.

📈 Return Profiles: Theoretical vs Realistic Outcomes

One of the most common questions investors ask is:

“Which earns more—SIP or lumpsum?”

The honest answer: it depends on timing, consistency, and market behavior.

🔹 Lumpsum: Higher Potential, Higher Risk

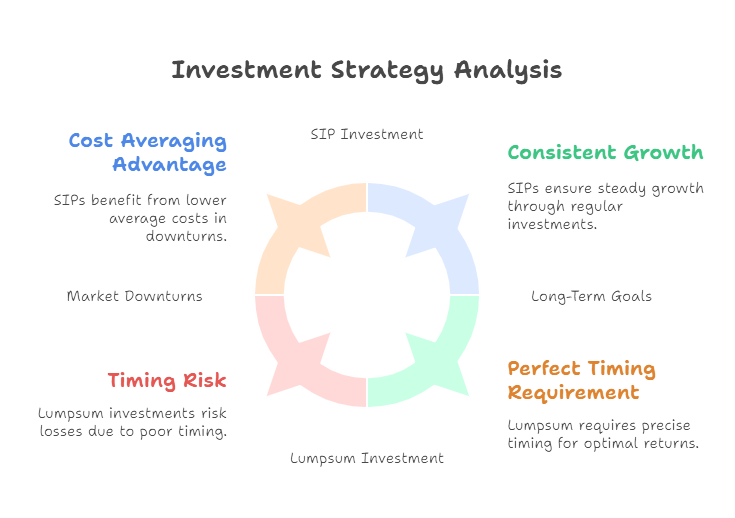

In theory, if you invest a large amount during a rising market, a lumpsum investment will almost always outperform an SIP started at the same time.

That’s because:

- All your money is exposed to market gains from day one

- Compounding starts immediately on the full principal

But that’s also what makes lumpsum investing risky. If you enter the market just before a downturn, you may spend months—or years—just recovering your initial capital.

🔹 SIP: Smoother Returns, Less Volatility Shock

SIP returns tend to be more stable over time because your capital enters the market gradually.

This reduces the impact of poor entry timing and avoids the emotional stress of watching a large investment fall in value.

SIPs are particularly effective in:

- Volatile or sideways markets

- Long-term investing (10+ years)

- Behavioral scenarios where discipline is more important than perfect timing

🔄 The Trade-Off

Strategy | Potential Upside | Risk Exposure | Volatility Buffer |

Lumpsum | High (if timed well) | High | Low |

SIP | Moderate | Lower | High |

You’re trading speed of returns for stability of entry. Lumpsum bets on the market. SIP bets on time and discipline.

SIP vs Lumpsum: Risk Management and Downside Exposure

Returns are important—but the ability to absorb loss is what defines long-term success. That’s where SIP and lumpsum investments diverge significantly.

Each approach manages downside risk differently, and your comfort with loss—temporary or prolonged—should influence your strategy.

🔹 SIP: Absorbs Volatility Gradually

SIPs act like a built-in shock absorber. Since you’re investing incrementally over time, only a portion of your capital is exposed during any given market drop.

This has two major benefits:

- You buy more when prices are down, lowering your average cost

- You avoid full exposure to peak market levels that may precede a decline

This makes SIPs especially effective during:

- Market downturns

- Bear cycles

- Periods of economic uncertainty

Rather than fearing red numbers, SIP investors continue investing through them—and are often rewarded for that patience.

🔹 Lumpsum: Immediate, Full Exposure

Lumpsum investing offers no such buffer.

Your entire capital is in the market from day one. If the market corrects shortly after you invest, you absorb 100% of that downside immediately.

For some investors, that’s a calculated risk. For others, it’s a psychological trap—one that leads to panic selling or abandoning long-term plans.

That doesn’t mean lumpsum is wrong. But it does mean you need to:

- Be emotionally prepared for volatility

Avoid investing right before known risk events (e.g., elections, earnings, rate hikes)

🧠 Practical Insight

- SIPs are a form of risk-controlled exposure

- Lumpsum demands conviction and resilience

Risk isn’t just about numbers—it’s about behavior. Choose a strategy that aligns with how you respond when things don’t go your way.

SIP vs Lumpsum: Flexibility and Modifiability

No investment journey goes exactly as planned. Life changes. Income fluctuates. Priorities shift. That’s why flexibility matters—not just at the point of entry, but throughout the investment lifecycle.

How easily you can adjust your strategy is a key factor in its long-term sustainability.

🔹 SIP: Adaptable by Design

SIPs are inherently flexible. You can:

- Increase or decrease your monthly amount

- Pause contributions temporarily during financial strain

- Resume investing when conditions stabilize

- Stop completely without penalty in most cases

This gives you greater control over your cash flow and investment commitment—without needing to redeem or exit the underlying fund.

SIPs are built to evolve with your financial situation.

🔹 Lumpsum: One Decision, Fully Committed

Lumpsum investing offers less flexibility after the initial investment is made.

- Once your money is deployed, you’re fully exposed to market conditions

- Adjusting your position usually means selling or exiting (which may involve tax implications or timing risk)

- There’s no automated path to scale up or down

That doesn’t make lumpsum rigid—but it’s less forgiving if circumstances change unexpectedly.

🎯 Strategy Fit

- If you value control, responsiveness, or automation, SIPs offer a smoother ride.

- If you’re confident in your plan and unlikely to need access to funds, lumpsum can still make sense.

Flexibility isn’t just a convenience—it’s a risk reducer.

🔁 Hybrid Strategy: Why Many Investors Use Both

SIP and lumpsum aren’t rivals. In practice, they work best when used together—each serving a different purpose, at a different time.

Smart investing isn’t about choosing one strategy forever. It’s about knowing when to use each method to your advantage.

🔹 How a Hybrid Approach Works

- Start with a lumpsum investment if you have idle capital (e.g., a bonus or windfall)

- Follow it with monthly SIP contributions to maintain consistent investing

- Use SIPs to keep building during volatile markets, and reserve lumpsum for high-conviction opportunities or long-term reallocations

This approach gives you:

- Immediate exposure to the market through the lumpsum

- Ongoing cost averaging and discipline via SIPs

Flexibility to manage cash flow while staying invested

🔹 Real-World Examples

- A professional receives a $20,000 bonus → invests $10,000 as a lumpsum, and commits the other $10,000 as $500/month SIP over 20 months.

- A long-term investor sells property → invests 60% in a lumpsum to take advantage of favorable market conditions, and the rest through SIPs for diversification and risk control.

🧠 Why It Works

- Lumpsum gives acceleration

- SIP provides stability

- Together, they build a portfolio that’s both responsive and resilient

You don’t have to pick a side. You just have to pick what works for your situation—and adjust as it evolves.

SIP vs Lumpsum: Common Misconceptions

The SIP vs lumpsum debate often gets distorted by half-truths and assumptions. Let’s clear the air by tackling a few of the most common myths.

❌ “Lumpsum always earns more than SIP.”

Only if the market rises immediately after you invest—and continues rising steadily.

In real life, markets fluctuate. Lumpsum can outperform in perfect conditions, but SIP protects against poor timing. Over longer periods, SIPs often deliver more stable outcomes, even if the total gains are slightly lower.

❌ “SIPs are for small investors only.”

Not true. SIPs are a strategy, not a status symbol. Many high-net-worth individuals use SIPs to stagger investments, reduce risk, and maintain liquidity. The discipline and flexibility of SIPs make them useful regardless of portfolio size.

❌ “You have to choose one or the other.”

This is one of the most limiting beliefs. The most successful investors use both—lumpsum when the opportunity is right, SIPs for consistency and control. These tools aren’t opposites. They’re complementary.

❌ “You can’t change your approach once you’ve started.”

Both strategies are adjustable. You can pause a SIP, add more to a lumpsum portfolio, or rebalance your mix as your financial situation evolves. Flexibility is part of long-term planning.

The takeaway: Don’t let myths force you into rigid thinking. Choose based on your needs, not internet debates.

📊 SIP vs Lumpsum: Side-by-Side Comparison

Factor | SIP | Lumpsum |

Capital Deployment | Invested gradually over time | Invested all at once |

Market Timing Risk | Lower (spreads entry points) | Higher (full exposure from day one) |

Behavioral Fit | Best for consistent, automation-friendly investors | Best for high-conviction, timing-aware investors |

Volatility Buffer | Strong (averages out price swings) | Weak (market entry timing critical) |

Cash Flow Fit | Ideal for monthly income earners | Suits one-time windfalls or large cash reserves |

Flexibility | Easy to start, pause, modify, or stop | Inflexible after initial investment |

Return Potential | Moderate, more stable | High if timed well, lower if mistimed |

Risk of Loss | Lower per installment | Higher if market dips after entry |

Best Use Case | Long-term goals, automation, wealth building | Quick capital deployment, tactical bets, market-entry conviction |

Emotional Comfort | Reduces pressure and emotional decision-making | Requires emotional resilience and confidence |

This table isn’t about choosing a winner. It’s about matching strategy to personal context, not headlines.

❓ Frequently Asked Questions (FAQs)

1. Which gives better returns—SIP or lumpsum?

There’s no universal answer. Lumpsum may generate higher returns if the market rises after your investment. SIPs, on the other hand, help smooth volatility and avoid poor timing. The better option depends on market conditions and your ability to stay invested during downturns.

2. Is SIP safer than lumpsum?

SIPs typically carry lower timing risk because they spread investments over time. That doesn’t make them risk-free, but they help reduce exposure to sudden market drops. Lumpsum carries higher risk if invested at the wrong time but can outperform when timed well.

3. Can I invest in both SIP and lumpsum at the same time?

Yes. Many investors use a hybrid approach—starting with a lumpsum if they have available capital, then continuing with SIPs to maintain discipline and average costs. This offers both immediate exposure and long-term structure.

4. What happens if I stop my SIP midway?

Stopping a SIP doesn’t cancel your investment. The units you’ve already purchased will remain in your account and continue to reflect market performance. You can resume, increase, or modify your SIP later based on your financial situation.

5. Does the tax treatment differ between SIP and lumpsum?

The tax rules are generally the same if both are invested in the same asset type (e.g., equity mutual funds). What differs is when gains are realized and taxed. For SIPs, each monthly installment has its own holding period. For lumpsum, the clock starts on the entire amount from day one.

🧾 Conclusion: Strategy Should Match Reality

SIP and lumpsum investing aren’t enemies—they’re tools. And like any tool, their value depends on how, when, and why you use them.

SIPs are built for consistency. They work quietly in the background, protecting you from volatility and enforcing discipline even when the market feels chaotic.

Lumpsum investments offer speed. They take full advantage of available capital—but demand clarity, timing, and the ability to stomach short-term risk.

There’s no one-size-fits-all answer. The right choice depends on:

- How your income flows

- How you react to risk

- How long you plan to stay invested

- And what level of flexibility you need

In truth, many investors don’t choose one or the other—they combine both.

They invest when capital is available, then stay consistent with SIPs over the long term. That flexibility is often what creates resilience.

The best strategy? It’s the one you’ll stick with.

Next Steps:

Read our full SIP Calculator breakdown here.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and you should always do your own research or consult a professional before making any financial decisions. Cryptocurrencies are volatile and involve significant risk of loss. Past performance is not indicative of future results.

1 thought on “SIP vs Lumpsum: Which Strategy Aligns with Your Financial Plan?”

Comments are closed.