Introduction

A Systematic Investment Plan (SIP) is one of the most structured ways to build long-term wealth—but estimating how your monthly contributions will grow over time can feel like guesswork without the right tool.

That’s where a good SIP calculator comes in.

An online SIP calculator gives you instant, data-backed projections of your future investment value based on key inputs like monthly contribution, expected annual return, and investment tenure. The best calculators go even further—offering options to simulate step-up contributions, add lumpsum investments, or factor in inflation and tax.

In this article, we’re not explaining how SIPs work—that’s already covered in our SIP Calculator Guide. Instead, we’re reviewing and comparing the top SIP calculators available online so you can choose the one that fits your strategy, planning style, and level of experience.

Whether you’re a beginner looking for simplicity or an advanced investor planning with inflation and tax in mind, there’s a tool out there built for you.

Let’s break down the features that actually matter—before you rely on projections that don’t match reality.

Key Takeaways

- SIP calculators help investors estimate future returns based on monthly contribution, expected return rate, and investment duration.

- The best calculators offer more than basic projections—they include step-up SIP options, tax adjustments, lumpsum add-ons, and inflation tracking.

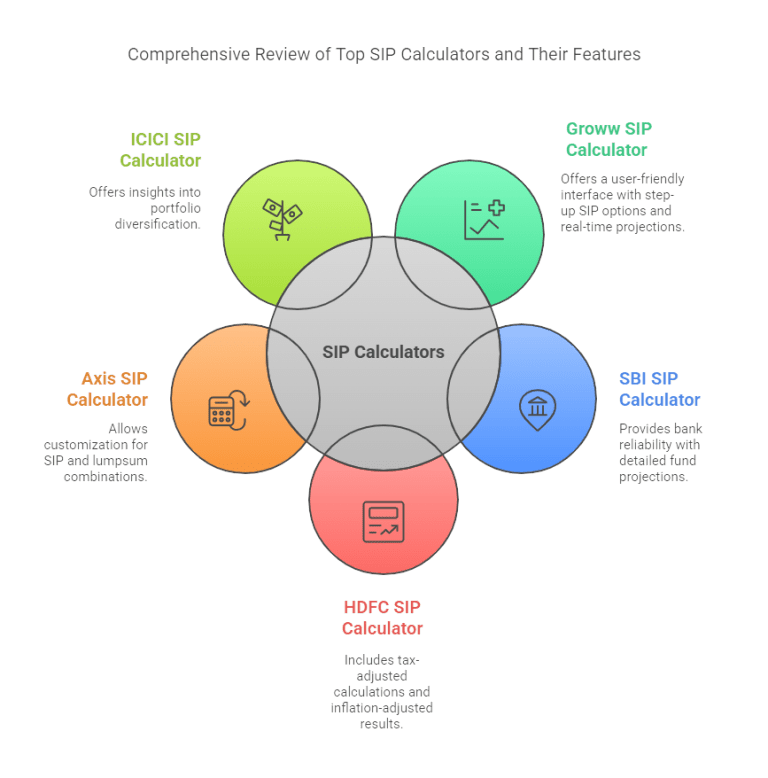

- Platforms like Groww, HDFC, ET Money, and SBI offer online SIP tools with varying degrees of customization and planning features.

- Choosing the right SIP calculator depends on your investment goals, comfort with complexity, and whether you value speed, precision, or both.

- In this guide, we compare leading tools side-by-side—so you can pick the one that fits your planning style, not just the one that shows the biggest number.

If you’re new to this concept, read our full SIP Calculator breakdown here.

🧩 What Makes a Good SIP Calculator?

At a glance, most SIP calculators seem identical—they all ask for your monthly investment, expected return, and duration. But if you dig deeper, the quality of insights they offer can vary dramatically.

The best calculators don’t just show you how much you might accumulate. They help you plan realistically, simulate different scenarios, and avoid blind spots that can derail long-term goals.

Here’s what actually matters when evaluating SIP calculators online:

🔹 1. Real-Time, Reliable Projections

Instant feedback matters. A high-quality SIP calculator updates your projected values live as you adjust inputs. No refresh buttons. No slow processing. Just immediate, transparent results—because if you’re testing multiple scenarios, speed and responsiveness make a big difference.

🔹 2. Step-Up SIP Functionality

Your income doesn’t stay flat year after year, and your investments shouldn’t either. A great calculator should let you simulate annual increases to your SIP contributions. This “step-up” feature helps model a more realistic growth path for people whose earning power expands over time.

🔹 3. Tax & Inflation Adjustments

Many calculators show future values in absolute terms. But smart investors want net returns—adjusted for taxes and reduced purchasing power. Calculators that include options for:

- Long-term capital gains (LTCG)

- Inflation indexing

Post-tax maturity estimates

offer a far more useful planning experience.

🔹 4. Lumpsum + SIP Hybrid Modeling

Few investors rely on SIPs alone. You might receive a bonus, inheritance, or profit windfall and want to invest a one-time amount alongside your monthly plan. Calculators that allow combined SIP + lumpsum projections help simulate mixed investment strategies in one place.

🔹 5. User Experience & Mobile Optimization

Planning should feel effortless. The best tools prioritize:

- Clean UI

- Intuitive sliders

- Mobile responsiveness

- Graphical output (charts, growth curves, breakdowns)

No one wants to do serious planning on a calculator that feels like a spreadsheet from 2004.

🔹 6. Mutual Fund Integration (Bonus)

Some calculators take it a step further by letting users plug in a specific mutual fund. These tools auto-fill historical return data or allow comparisons based on fund type (equity, debt, hybrid). Not a must-have, but great for experienced users looking for deeper context.

In short, a good SIP calculator doesn’t just calculate—it helps you think through your investment path. Now let’s break down the top options and see which one aligns with your planning needs.

🟦 SBI SIP Calculator Review

The SBI Mutual Fund SIP calculator comes from one of India’s most trusted financial institutions. While the tool doesn’t lead in features or UX, it earns points for reliability, transparency, and institutional backing.

It’s straightforward, conservative in design, and gets the job done for investors who prefer simplicity and traditional planning.

🔹 Interface & Usability

The SBI calculator offers a no-frills experience. It’s web-based, with clearly labeled fields for:

- Monthly investment amount

- Expected return rate

- Investment duration

Once inputs are filled, it calculates your maturity amount along with a simple chart showing investment vs returns.

It lacks modern design elements and feels dated on mobile, but it’s functional and stable.

🔹 Key Features

- ❌ Step-Up SIP Option: Not available

- ❌ Tax or Inflation Adjustments: Not supported

- ❌ Lumpsum Add-On: Not integrated

- ✅ Basic SIP Projection: Yes

- ✅ Institutional Credibility: Backed by SBI Mutual Fund

- ❌ Advanced Visualization: Limited to a basic chart

🔹 Best For

- Conservative or first-time investors

- Users who value simplicity over customization

- Those already invested in SBI Mutual Funds

🔻 Limitations

The calculator lacks flexibility:

- No way to simulate income growth or step-up strategies

- No tax or inflation modeling

- No combo strategy (SIP + lumpsum)

It’s useful for quick calculations, but not for scenario planning or long-term forecasting.

Verdict: A reliable, no-nonsense SIP calculator for basic use. Best suited for traditional investors who want to run static projections without toggling through extra features. Not recommended if you’re optimizing for growth or tax efficiency.

🟥 HDFC SIP Calculator Review

The HDFC Mutual Fund SIP calculator brings a balance of simplicity and functionality, with a few standout features that make it especially useful for long-term, inflation-conscious investors.

While the interface isn’t as sleek as newer platforms, the tool includes one rare feature most calculators skip: inflation-adjusted projections.

🔹 Interface & Usability

The tool’s interface is functional but dated. It includes:

- Input fields for monthly SIP amount, expected return rate, and investment duration

- An option to toggle inflation adjustment, which recalculates your maturity value in real-world terms

Projections appear below with a comparison between nominal returns and inflation-adjusted returns, helping you understand how much your money might actually be worth in future purchasing power.

🔹 Key Features

- ✅ Inflation Adjustment: Yes — rare and useful

- ❌ Step-Up SIP: Not available

- ❌ Lumpsum Integration: Not included

- ✅ Side-by-Side Real vs Adjusted Value: Yes

- ✅ Long-Term Focus: Ideal for goals like retirement planning

- ❌ Modern UI or Mobile Optimization: Lacks polish

🔹 Best For

- Investors focused on real returns, not just big numbers

- Those planning for long-term goals like education or retirement

- Users who want clarity about inflation’s impact on their projections

🔻 Limitations

- No step-up SIP or lumpsum input options

- Interface feels outdated compared to newer platforms

- Mobile experience isn’t ideal

This tool is meant for deliberate planning—not casual tinkering.

Verdict: HDFC’s SIP calculator is one of the few tools that shows the impact of inflation on your future corpus. While not flashy, it’s a strong pick for investors who want to plan realistically, not optimistically.

🟨 ET Money SIP Calculator Review

Among all the tools in this comparison, ET Money’s SIP calculator stands out as the most feature-rich and planning-oriented option. It’s built for users who want more than a maturity number—they want insights.

This calculator offers not only projections but also allows for tax-adjusted, inflation-adjusted, and even custom step-up SIP strategies—a rare combination in a free tool.

🔹 Interface & Usability

The layout is modern, clean, and fast. You can toggle between:

- Regular SIP

- Step-Up SIP

- Post-tax returns

- Inflation-adjusted projections

You also get a detailed results breakdown showing:

- Total investment

- Total gains

- Tax impact

- Net corpus after inflation and tax

The experience feels intuitive, even though the inputs go deeper than most.

🔹 Key Features

- ✅ Step-Up SIP Modeling

- ✅ Tax Adjustment (LTCG for equity funds)

- ✅ Inflation Adjustment

- ❌ Lumpsum Add-On: Not currently integrated

- ✅ Dynamic Graphs & Breakdowns

- ✅ Mobile-Friendly (through app)

🔹 Best For

- Advanced users looking for precision

- Tax-conscious investors

- People planning long-term goals who want to see real purchasing power

🔻 Limitations

- No SIP + lumpsum hybrid projection in one tool

- Could feel “too detailed” for first-time investors

- Primarily web/app-based—less ideal if you’re looking for something offline or ultra-light

Verdict: If you’re serious about optimizing SIPs, ET Money’s calculator is as close as it gets to a full planning suite—without needing a spreadsheet or advisor. It’s ideal for users who want to stress-test their assumptions with real-world variables like taxes and inflation.

🟪 Axis SIP Calculator Review

The Axis Mutual Fund SIP calculator takes a slightly different approach by emphasizing investment combinations. It allows users to simulate both SIP and lumpsum contributions in a single calculation—making it ideal for investors following a hybrid approach.

While it doesn’t offer inflation or tax adjustments, it shines in its ability to model more complex capital deployment strategies in one go.

🔹 Interface & Usability

The design is clean and functional. Unlike many calculators that limit inputs to SIP-only, Axis lets you enter:

- Monthly SIP amount

- One-time lumpsum amount

- Investment duration

- Expected annual return

Results update immediately and display a simple breakdown of:

- Total investment

- Total estimated returns

- Maturity value

No login is required, and the mobile experience is solid.

🔹 Key Features

- ✅ SIP + Lumpsum Simulation

- ❌ Step-Up SIP: Not available

- ❌ Tax or Inflation Adjustments: Not supported

- ✅ Simple, Unified Dashboard

- ✅ Web and Mobile Compatibility

🔹 Best For

- Users who plan to combine strategies (e.g., initial lumpsum + ongoing SIP)

- Intermediate investors who want more than basic projections but not full tax/inflation modeling

People seeking clarity on how different contribution methods interact

🔻 Limitations

- No advanced planning variables like step-up or inflation

- Limited breakdown (no real-time charts or post-tax clarity)

- Results are nominal and do not factor purchasing power

Verdict: Axis’s calculator fills an important niche—it’s ideal for modeling hybrid investing without overcomplicating things. While not the most advanced tool, it gives a clearer view of blended capital strategies than most calculators in this space.

📊 Comparison Table: Best SIP Calculators At a Glance

Tool | Step-Up SIP | Tax Adj. | Inflation Adj. | Lumpsum Add-On | Ease of Use | Best For |

Groww | ✅ | ❌ | ❌ | ❌ | ⭐⭐⭐⭐⭐ | Beginners, mobile users |

SBI | ❌ | ❌ | ❌ | ❌ | ⭐⭐⭐ | Conservative, first-time investors |

HDFC | ❌ | ❌ | ✅ | ❌ | ⭐⭐⭐⭐ | Long-term, inflation-aware planners |

ET Money | ✅ | ✅ | ✅ | ❌ | ⭐⭐⭐⭐ | Advanced, tax-conscious investors |

Axis | ❌ | ❌ | ❌ | ✅ | ⭐⭐⭐⭐ | Hybrid strategy users |

🎯 Which SIP Calculator Is Right for You?

There’s no one-size-fits-all SIP calculator. The best tool depends on how you invest, what kind of planning you want to do, and how much control or customization you prefer.

Use this section to match your needs with the right platform—so you’re not just running numbers, but running smarter scenarios that actually reflect your investment behavior.

✅ If You’re Just Getting Started

Use the Groww SIP Calculator.

It’s designed for simplicity. You’ll get immediate results, a clean interface, and zero friction—making it ideal for first-time investors or those who want to understand the basics without distractions. It also supports step-up projections, which is helpful if you expect to increase your contributions over time.

🧩 Perfect for mobile-first users, casual planners, and beginners who just want a quick “what-if” view.

✅ If You Prefer Conservative, No-Nonsense Planning

Try the SBI or HDFC SIP Calculator.

SBI’s tool is minimal and straightforward—ideal for those who want basic projections without complex features. HDFC takes it a step further by offering inflation-adjusted returns, which makes a big difference when planning for goals 10–20 years out.

🧩 Best suited for traditional investors or those working with bank-linked mutual funds.

✅ If You Want to See Real, Post-Tax Returns

Use the ET Money SIP Calculator.

This one’s for serious planners. It allows you to adjust for taxes, inflation, and annual SIP increases, giving you a more grounded view of what your investments might actually be worth. It’s perfect for those planning long-term goals like education, retirement, or early financial independence.

🧩 Ideal for tax-sensitive investors, salaried professionals, or anyone who wants accuracy beyond face-value projections.

✅ If You’re Combining SIP and Lumpsum Contributions

Choose the Axis SIP Calculator.

Many investors don’t use just one approach—they start with a lump sum and follow it with monthly SIPs. Axis’s calculator lets you model both together, something most others don’t. While it lacks inflation and tax options, the hybrid modeling is its unique strength.

🧩 Great for users who’ve received a bonus, sold an asset, or want to simulate mixed strategies in one place.

🧠 Pro Tip: Don’t limit yourself to one calculator. Use multiple tools for different planning layers. Quick tools help validate ideas fast. Detailed ones help finalize actual decisions.

Sometimes, the real value isn’t in the output—it’s in testing different paths before committing to one.

❓ Frequently Asked Questions (FAQs)

1. What is an SIP calculator used for?

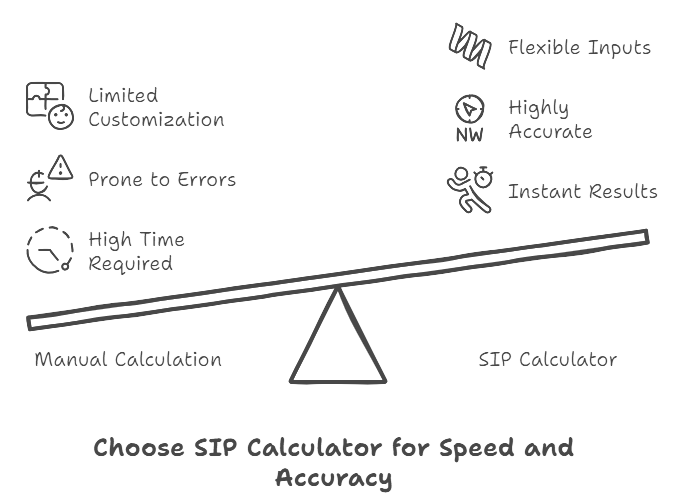

An SIP calculator estimates the future value of your mutual fund investments based on three main variables: your monthly contribution, expected rate of return, and investment duration. It helps you visualize how consistent investing grows over time—without doing manual math.

2. Are online SIP calculators accurate?

Yes—SIP calculators are accurate as long as the inputs reflect realistic expectations. Keep in mind that they don’t guarantee returns, and most do not factor in market volatility, fund-specific performance, or taxes unless explicitly stated.

3. Can I use an SIP calculator to plan retirement or college funds?

Absolutely. In fact, long-term goals like retirement, education, or large purchases are exactly what SIP calculators are best for. Tools that include inflation and tax adjustments (like ET Money or HDFC) are especially helpful for realistic planning.

4. Which SIP calculator is best for tax planning?

The ET Money SIP Calculator includes options to account for long-term capital gains tax, making it ideal for users who want a net-of-tax projection. Most others show gross returns only.

5. What’s the difference between SIP and lumpsum calculators?

A SIP calculator estimates returns on recurring monthly investments. A lumpsum calculator projects growth on a one-time investment. Some tools (like Axis) allow you to model both in a hybrid scenario, but most calculators focus on one or the other.

6. Do I need to sign up to use these calculators?

No. All calculators reviewed in this article are free and don’t require login or registration. However, some platforms may offer additional features if you use their app or create an account.

🧾 Conclusion

SIP calculators do more than crunch numbers—they help you make informed decisions with clarity and confidence.

Whether you’re just starting out or refining a long-term investment plan, the right tool can reveal blind spots, stress-test your assumptions, and simplify complex projections. From clean and quick platforms like Groww, to feature-rich tools like ET Money, there’s no shortage of options.

The key isn’t picking the calculator with the most features—it’s choosing the one that aligns with your planning style.

Use fast tools when you need quick validation. Use deeper tools when you need realistic, tax-adjusted clarity. And use both if you want to approach your financial goals like a strategist, not a speculator.

Whatever you choose, make your projections intentional—and let the numbers guide smarter action.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and you should always do your own research or consult a professional before making any financial decisions. Cryptocurrencies are volatile and involve significant risk of loss. Past performance is not indicative of future results.