Introduction

Cryptocurrency is more than just digital money — it’s a radical shift in how value moves across the internet.

At its core, cryptocurrency is a decentralized, peer-to-peer system that lets people send and receive money without banks, borders, or middlemen. It runs on blockchain technology, which records every transaction on a transparent, tamper-proof ledger.

Since the launch of Bitcoin in 2009, crypto has grown into a global ecosystem of digital assets, financial tools, and decentralized apps. Whether you’re a curious beginner or a cautious investor, understanding how cryptocurrency works is the first step toward navigating the future of finance.

This guide will break down what crypto is, how it functions, what it’s used for — and whether it’s worth your attention (or investment).

Key Takeaways

- Cryptocurrency is digital money that operates on decentralized networks, secured by cryptography and powered by blockchain technology.

- Unlike traditional currencies, crypto allows peer-to-peer transactions without banks or governments.

- Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT.

- Users can buy, sell, trade, invest, or use crypto for payments, DeFi, gaming, and more.

- Cryptocurrency is digital money that operates on decentralized networks, secured by cryptography and powered by blockchain technology.

What Is Cryptocurrency?

Cryptocurrency is a form of digital money designed to work without banks, governments, or centralized control.

Instead of relying on traditional institutions, cryptocurrencies use blockchain technology — a distributed digital ledger — to record transactions and verify ownership. Every time someone sends or receives crypto, that transaction is permanently logged on a public blockchain that anyone can inspect but no one can alter.

The first and most well-known cryptocurrency, Bitcoin, was launched in 2009. Since then, thousands of digital currencies have emerged, each with its own use case — from decentralized finance and gaming to privacy, global payments, and smart contracts.

Unlike physical cash or fiat currencies (like the U.S. dollar), most cryptocurrencies exist only in digital form and are secured by cryptography, making them difficult to counterfeit or hack.

What makes crypto revolutionary is that it lets people store, move, and grow value without needing permission from a bank, government, or payment processor.

How Cryptocurrency Works

To understand how cryptocurrency works, you need to look at the three core components that power the entire ecosystem: blockchain technology, digital wallets, and consensus mechanisms like mining or staking.

1. Blockchain Technology

At the heart of every cryptocurrency is a blockchain — a digital ledger that records all transactions in a transparent, tamper-resistant format.

Instead of being stored on a single server, the blockchain is distributed across a network of computers (called nodes), which work together to verify and store each transaction.

Once a transaction is validated by the network, it’s added to a block and becomes a permanent part of the ledger — visible to all, but unchangeable.

2. Wallets and Transactions

To store and send crypto, users rely on digital wallets, which come in two main forms:

- Hot wallets: Software-based wallets connected to the internet (like apps and browser extensions). Easy to use but more vulnerable to hacks.

- Cold wallets: Offline wallets, such as hardware devices, that offer stronger security for long-term storage.

Each wallet has a public address (used to receive funds) and a private key (used to authorize transactions).

Think of your wallet address like your email — and your private key like the password. Lose it, and you lose your crypto.

3. Mining and Staking

New coins are introduced and transactions are validated using two major models:

- Mining (Proof of Work): Powerful computers solve complex puzzles to validate transactions. Used by Bitcoin and others, mining is energy-intensive but secure.

- Staking (Proof of Stake): Users lock up coins to help validate the network and earn rewards. It’s faster and more energy-efficient, used by networks like Ethereum (post-merge) and Solana.

These systems are what keep blockchains running smoothly without needing a central authority.

What Is Cryptocurrency Used For?

Cryptocurrency is more than just a digital asset — it’s a technology layer that’s redefining how we store, send, and interact with value. While investing gets most of the attention, crypto’s real-world applications are expanding far beyond speculation.

Here are the primary (and rapidly growing) ways people use cryptocurrency today:

1. Digital Payments and Remittances

Cryptocurrency was originally designed as a decentralized form of money. Bitcoin, for example, was created to let people transact directly — without needing banks, governments, or third-party processors.

Now, millions of people use crypto to:

- Send money across borders in seconds (often with lower fees than banks)

- Pay for online services or products at merchants who accept crypto

- Settle invoices or freelance payments globally using stablecoins like USDC or DAI

This makes crypto a powerful tool in countries with unstable currencies or limited banking access.

2. Investing and Speculation

Let’s be honest — most people discover crypto because of price movement.

Bitcoin’s rise from pennies to tens of thousands of dollars turned early holders into millionaires — and triggered a wave of investing interest.

Today, investors use crypto for:

- Long-term holding (HODLing) — betting that scarcity or adoption will drive price over time

- Swing trading or day trading — profiting from short-term price volatility

- Earning yield — through staking, lending, or providing liquidity to decentralized exchanges

Many also diversify across crypto sectors: infrastructure (ETH, SOL), DeFi (AAVE, UNI), gaming (AXS, SAND), and stablecoins.

3. Decentralized Finance (DeFi)

DeFi refers to blockchain-based financial tools that operate without banks.

Using DeFi apps (often called DApps), users can:

- Earn interest on their crypto

- Borrow without a credit score

- Swap tokens instantly

- Buy insurance, run DAOs, and more — all without paperwork or waiting periods

Top DeFi platforms include Uniswap, Aave, Curve, Compound, and MakerDAO — all powered by smart contracts.

4. NFTs and Digital Ownership

NFTs (Non-Fungible Tokens) allow users to own unique digital items — whether that’s artwork, music, video clips, gaming assets, or even virtual land.

Crypto powers the buying, selling, and verification of these assets, often on platforms like:

- OpenSea (NFT marketplace)

- Rarible, Blur, and Magic Eden

- Play-to-earn games like Axie Infinity, Decentraland, and The Sandbox

NFTs have become a new asset class and creative economy, allowing artists, gamers, and developers to monetize digital content in new ways.

5. Real-World Use Cases: Identity, Data, and Beyond

Beyond money, crypto technology is now being applied to:

- Digital identity verification

- Blockchain voting systems (for secure, tamper-proof elections)

- Tokenized assets like real estate, stocks, or carbon credits

- Supply chain tracking to prove authenticity of goods

- Streaming payments for creators and developers in real time

These innovations are building the foundation for Web3 — a decentralized internet where users own their data, assets, and digital identity.

Bottom line: cryptocurrency isn’t just a financial tool — it’s a global infrastructure shift. The use cases are growing fast, and we’ve only seen the beginning.

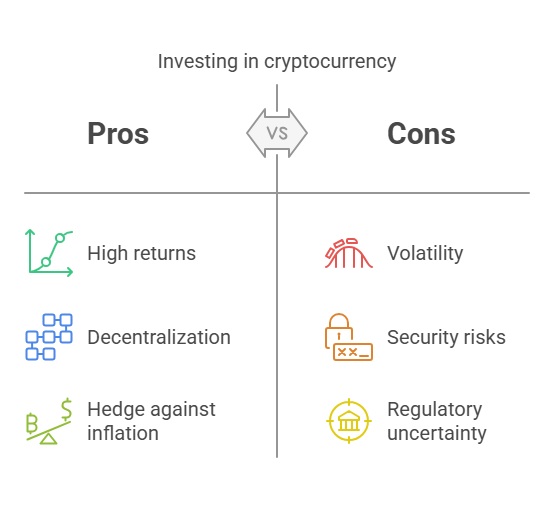

Is Cryptocurrency a Good Investment?

The answer depends on your risk tolerance, time horizon, and why you’re investing in the first place.

Cryptocurrency has created life-changing returns for early adopters — but it’s also wiped out fortunes overnight. It’s not a guaranteed win, and it’s not for the faint of heart. Here’s what you need to consider:

✅ Pros of Investing in Cryptocurrency

- High Growth Potential

Bitcoin rose from under $1 to over $60,000 in just over a decade. Other coins like Ethereum, Solana, and early DeFi tokens have also delivered massive returns.

- Decentralization and Ownership

Unlike stocks or cash in a bank, you can truly own your crypto. No middlemen, no gatekeepers — just your keys, your coins.

- 24/7 Global Markets

Crypto trades 24/7, across every timezone, with no centralized closing bell — giving investors more flexibility and access.

- Hedge Against Inflation

Coins with fixed or deflationary supply (like Bitcoin) are positioned as “digital gold” and appeal to those looking to preserve long-term value.

- Access to New Sectors

With a single wallet, you can invest in early-stage tech, gaming ecosystems, digital real estate, and more.

⚠️ Cons and Risks of Crypto Investing

Extreme Volatility

It’s not uncommon for coins to drop 20–50% in a week. Prices are highly emotional and reactive to news, hype, and market sentiment.

Security Risks

Exchanges can be hacked. Wallets can be compromised. Lose your private keys, and you lose your coins — forever.

Regulatory Uncertainty

Laws vary by country and change fast. Crypto assets may be taxed as property, income, or securities — depending on how and where you use them.

Speculation Over Fundamentals

Many tokens rise in price based on hype, not utility. Some projects vanish. Some are outright scams. DYOR (Do Your Own Research) is not optional.

The Bottom Line

Crypto can absolutely be a part of a modern investment portfolio — but it should be a calculated risk, not a blind leap.

If you’re in it for quick profits, you’re gambling. If you’re in it with strategy, research, and risk management — you’re investing in the future.

How to Buy and Store Cryptocurrency

Getting started with crypto is easier than ever — but how you buy and store it can make the difference between a secure investment and a costly mistake.

Here’s how to do it the right way:

1. Choose a Trusted Exchange

Start by picking a reliable cryptocurrency exchange where you can buy, sell, and trade coins.

Top options include:

- Coinbase – beginner-friendly, U.S. regulated

- Binance – global reach, low fees

- Kraken – strong security, good for serious investors

- KuCoin – wide coin variety, trading features

Look for platforms with strong security, good customer support, and clear fee structures.

2. Create and Verify Your Account

Sign up and complete KYC (Know Your Customer) verification. This usually means uploading ID and connecting a payment method (bank transfer, debit card, etc.).

Once verified, you’ll be able to deposit funds and start trading.

3. Buy Your First Crypto

Most platforms let you buy popular coins like:

- Bitcoin (BTC) – the original, limited-supply store of value

- Ethereum (ETH) – the foundation of smart contracts and DeFi

- USDT/USDC – stablecoins pegged to the U.S. dollar

You can buy fractional amounts — you don’t need a full Bitcoin to get started.

4. Secure Your Crypto: Hot vs Cold Storage

Once you own crypto, don’t leave large amounts sitting on an exchange. You need a wallet — and there are two main types:

- Hot Wallets (online): Apps or browser extensions like MetaMask, Trust Wallet, or Coinbase Wallet. Convenient, but more vulnerable to hacks.

- Cold Wallets (offline): Hardware wallets like Ledger or Trezor that store your keys offline. Best for long-term, high-value holdings.

Pro tip: If it’s not your keys, it’s not your crypto. Always back up your seed phrase and store it offline — never share it with anyone.

Buying crypto is simple. Securing it is where most people mess up.

Get both right, and you’re off to a strong start.

Biggest Risks in Crypto

Crypto offers massive opportunity — but it’s not a playground for the careless. Volatility, scams, and tech mistakes can destroy capital faster than most new investors realize.

Here are the risks that matter most:

1. Price Volatility

Crypto markets are famously wild. Prices can soar or crash 30–50% in days, driven by hype, fear, or a single tweet.

If you invest emotionally, you’ll likely buy high and sell low — the exact opposite of what works.

2. Hacks and Scams

Billions of dollars have been lost to:

- Exchange hacks

- Rug pulls (fake projects that vanish)

- Phishing attacks

- Fake wallet apps and scam tokens

One wrong click or misstep, and your crypto could be gone — permanently.

3. Regulatory Risk

Crypto regulation is a moving target. Governments around the world are still figuring out how to classify and control digital assets.

This can affect everything from taxes to what platforms you’re allowed to use — and in some cases, even whether a project is legal to hold or trade.

4. Loss of Access

Crypto gives you full control — but also full responsibility. Lose your private key, forget your seed phrase, or send funds to the wrong address, and there’s no “reset password” button. The blockchain is unforgiving.

5. Overhype and Speculation

Many tokens pump based on nothing but marketing and memes. If you’re chasing trends without understanding the fundamentals, you’re not investing — you’re gambling.

How to Protect Yourself:

- Use hardware wallets for serious holdings

- Double-check every address before sending crypto

- Only invest what you’re prepared to lose

- Stay updated on crypto laws in your region

- Never share your seed phrase. Ever.

Crypto is powerful — but so is its downside. Know the risks before you chase the rewards.

The Future of Cryptocurrency

Cryptocurrency is no longer a fringe experiment — it’s evolving into a global financial layer with real-world impact.

From governments to tech giants, the world is waking up to what crypto can do. And the next decade will likely see even more rapid change.

Here’s what’s shaping the future:

🌍 Mainstream Adoption

Major payment platforms like PayPal, Visa, and Mastercard now support crypto. Big brands — from Starbucks to Gucci — have experimented with crypto payments or NFTs.

As wallets, apps, and regulations mature, using crypto could become as normal as swiping a credit card — especially in countries facing inflation or limited banking access.

🏛️ Government Regulation and Legal Frameworks

Governments are tightening focus on crypto — not to kill it, but to control it.

Expect clearer tax rules, licensing for exchanges, and oversight on stablecoins and DeFi platforms.

This could reduce scams and volatility, but also raise barriers for new projects and privacy-focused coins.

💳 Central Bank Digital Currencies (CBDCs)

Over 100 countries are researching or testing CBDCs — state-backed digital currencies built on blockchain-inspired infrastructure.

CBDCs aren’t the same as Bitcoin. They’re centralized, programmable, and fully government-controlled. Still, they show that crypto tech is shaping the future of money — even if some versions don’t align with crypto’s decentralized roots.

🏗️ Web3, Gaming, and Ownership

Blockchain isn’t just for money. It’s powering the rise of Web3 — a decentralized internet where users own their data, identity, and assets.

We’re seeing this already in:

- NFT-based games with real economies

- Tokenized digital identity

- Creator platforms that pay users directly in crypto

Crypto’s future isn’t just financial — it’s cultural, social, and digital.

Whether you’re a believer or a skeptic, one thing is clear: Cryptocurrency is here to stay — and it’s just getting started.

FAQs About Cryptocurrency

Q: Can cryptocurrency be converted to cash?

Q: Is cryptocurrency real money?

A: Yes — in the sense that it can be used to pay for goods, services, and even salaries in some cases. While it’s not legal tender in most countries, many businesses now accept crypto as a valid payment method.

Q: What are the biggest risks of investing in crypto?

A: The top risks include high price volatility, scams and hacks, regulatory changes, and loss of access if you mismanage your private keys or seed phrase. Only invest what you can afford to lose.

Q: How is cryptocurrency taxed?

A: In most countries, crypto is taxed as property or capital assets. That means profits from trading, selling, or earning crypto are subject to capital gains tax. Always consult a tax professional in your region for current rules.

Q: Can I lose all my money in crypto?

A: Yes. If you fall victim to a scam, lose access to your wallet, or buy into a worthless token, losses can be total. That’s why research, security, and diversification are critical.

Conclusion: Cryptocurrency Is a Revolution — But It’s Not a Shortcut

Cryptocurrency is more than just digital money — it’s a new financial system being built in real time.

From peer-to-peer payments and decentralized investing to NFTs and digital identity, crypto is reshaping how we store, send, and control value online. But it’s not without risk. Volatility, scams, and uncertainty still loom large — especially for beginners.

That’s why education is everything.

If you’re curious, start small. Learn how wallets work. Understand blockchain basics. Study the market before you invest a dollar. Because crypto isn’t just about getting in early — it’s about staying smart long enough to benefit from what’s coming next.

The future of finance is being written now. The question is: Will you watch it happen — or be part of it?

Learn more about crypto terms in our Glossary Page.

2 thoughts on “Cryptocurrency: What It Is and How It Works”