Introduction

Circulating supply is one of the most important — and misunderstood — metrics in cryptocurrency.

It refers to the number of coins that are currently available for trading on the open market. Not all coins created by a project are in circulation. Some are locked, reserved, or burned. That’s why circulating supply gives a more accurate view of how much crypto is actually in play.

This number matters because it’s used to calculate market capitalization — one of the main ways traders compare and value crypto assets. It also influences price volatility, scarcity, and investor sentiment.

In this article, we’ll break down what circulating supply really means, how it compares to total and max supply, and how it can help you better evaluate the potential of any cryptocurrency.

Key Takeaways

- Circulating supply refers to the number of cryptocurrency tokens currently available for public trading.

- It directly impacts a coin’s market capitalization (Market Cap = Circulating Supply × Price).

- Low circulating supply often creates scarcity, which can lead to higher prices and increased volatility.

- High circulating supply tends to increase liquidity but may limit upside unless demand grows significantly.

- Token burns, staking locks, and team reserves reduce circulating supply and affect price behavior over time.

- Understanding supply mechanics helps investors evaluate value, risk, and long-term potential in any crypto asset.

What Is Circulating Supply in Cryptocurrency?

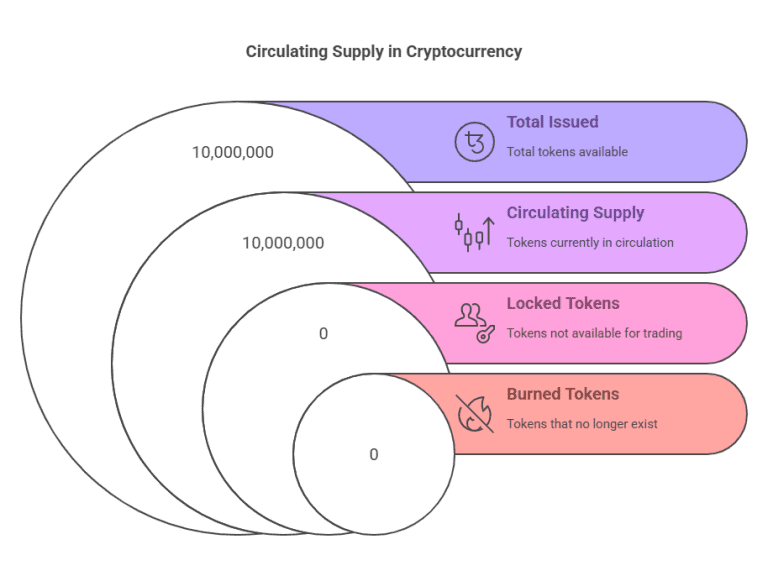

Circulating supply is the number of cryptocurrency tokens that are currently available to the public and actively trading in the market.

It does not include tokens that are locked, staked, reserved for developers or early investors, or burned. That’s why it’s considered the most accurate measure of how much of a coin is truly in play.

Unlike total supply (which includes all tokens created minus those burned) or maximum supply (the hard cap a coin can ever reach), circulating supply is a real-time snapshot of what’s accessible now — not what exists on paper.

This metric helps investors assess how scarce or inflated a cryptocurrency really is.

For example, Bitcoin’s max supply is 21 million, but not all of those coins are in circulation yet. Meanwhile, some tokens like Dogecoin have billions in circulation, which affects how their price behaves and how they’re perceived by the market.

How Is Circulating Supply Calculated?

Circulating supply is calculated by subtracting non-circulating tokens from the total number of tokens created by a project.

Here’s what typically gets excluded:

- Locked tokens: Coins held in vesting schedules for team members or early investors

- Staked tokens: Coins committed to securing a blockchain or earning yield, often temporarily inaccessible

- Reserved or escrowed tokens: Funds allocated for future use or strategic partnerships

- Burned tokens: Coins that have been permanently removed from circulation via smart contracts or manual burns

What’s left — the tokens freely moving in the market — is the circulating supply.

This number can fluctuate over time as tokens are unlocked, minted, burned, or released into the ecosystem.

Circulating supply is also essential in calculating market capitalization using the formula:

Market Cap = Circulating Supply × Current Price

For example: If a token has 10 million coins in circulation and each is worth $5, the market cap is $50 million — regardless of how many coins are locked or coming later.

Circulating Supply vs Total Supply vs Max Supply

Understanding how these three metrics differ — and how they interact — is essential to evaluating a cryptocurrency’s value, scarcity, and growth potential.

Let’s break them down clearly:

Circulating Supply

This is the number of coins or tokens currently available for public trading.

It excludes any assets that are locked up, reserved for the team or investors, staked, or permanently burned.

Because it represents what’s actually moving in the market, circulating supply is the key figure used to calculate market capitalization — which influences how the broader market perceives a coin’s value.

Total Supply

This includes all tokens that have been created or minted, minus those that have been burned or destroyed.

It reflects the full quantity of coins that exist, whether they’re circulating or not.

Tokens still locked in team wallets, long-term vesting contracts, or staking protocols are included here — even if they’re not currently available to trade.

Maximum Supply

This is the absolute cap — the maximum number of tokens that will ever exist, based on the project’s code or monetary policy.

Some projects have fixed max supplies (like Bitcoin), while others are inflationary or have no hard cap at all (like Ethereum or Dogecoin, unless otherwise stated).

🔍 Real-World Example: Bitcoin (BTC)

- Max Supply: 21 million — hard-coded, never to be exceeded

- Total Supply: Nearly 21 million — minus burned/lost coins

- Circulating Supply (today): Around 19 million — some mined coins are inaccessible, others remain locked or lost forever

As Bitcoin approaches its max supply (expected around 2140), its circulating supply will stabilize — and scarcity will increase, potentially driving price up if demand holds.

When you analyze a crypto project, these three metrics help answer core investor questions:

- How much supply is currently influencing price?

- How much more could hit the market in the future?

- Is the asset inherently scarce, or will supply dilute over time?

Understanding this supply landscape helps you identify undervalued coins, overhyped risks, or long-term scarcity plays — before the rest of the market catches on.

How Circulating Supply Affects Cryptocurrency Prices

In crypto, supply isn’t just a background metric — it’s one of the most powerful forces shaping a coin’s price, volatility, and investor perception.

Here’s how circulating supply moves the market:

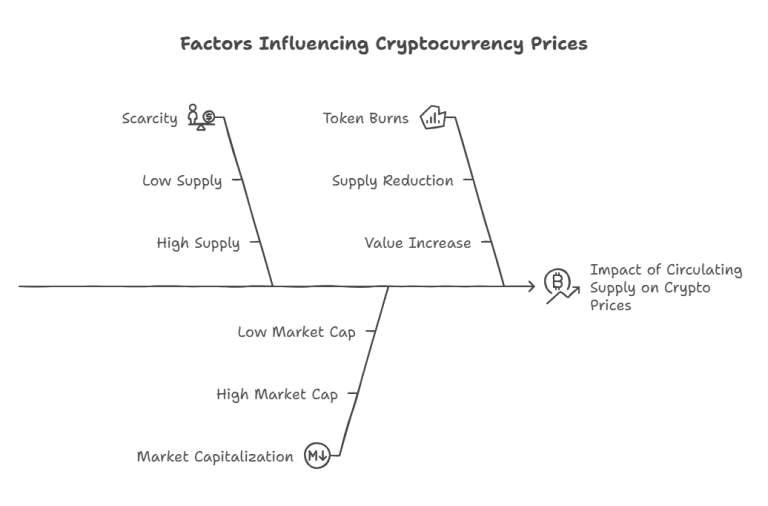

1. Scarcity Drives Price Perception

A coin with a low circulating supply often feels scarce — and scarcity fuels value.

This is why tokens like Yearn Finance (YFI), with only ~36,000 in circulation, have traded at higher prices than even Bitcoin at times.

On the flip side, coins like Dogecoin or XRP have billions in circulation. This high supply gives them liquidity and accessibility, but also makes it harder for the price to climb dramatically without massive demand.

2. Market Cap = Circulating Supply × Price

Circulating supply is a core component of market capitalization — the most widely used metric for ranking and valuing cryptocurrencies.

Two coins priced at $1 each can have wildly different market caps depending on how many tokens are in circulation.

More supply = larger market cap = higher barrier to growth.

- Example: A token priced at $1 with 1 billion coins in circulation has a $1B market cap — a high hurdle for 10x growth.

3. Token Burns Reduce Supply (and Boost Scarcity)

Some projects deliberately burn tokens — sending them to an irretrievable address — to reduce circulating supply over time.

This creates artificial scarcity and can support price appreciation, assuming demand stays constant or increases.

- Example: Binance Coin (BNB) uses quarterly token burns to reduce supply, aligning long-term price incentives with demand growth.

4. Supply Changes Shift Market Sentiment

Announcements about vesting unlocks, staking releases, or massive burns can dramatically impact price — even before the supply changes actually happen.

Investors react not just to current supply, but to what they believe supply will be in the near future.

In short: Circulating supply shapes everything — price volatility, perceived value, and long-term upside. Ignore it, and you’re trading blind.

What Happens When a Cryptocurrency Reaches Max Supply?

When a cryptocurrency hits its maximum supply, it means no more coins will ever be created. The faucet shuts off — permanently.

This can have a profound effect on how the asset behaves in the market, especially if demand continues to grow while supply becomes fixed.

Here’s what typically happens:

🔒 Scarcity Increases

With no new tokens entering circulation, the available supply becomes more valuable — if demand holds or rises.

This supply cap can create a deflationary effect, making each token feel rarer over time.

⛏️ Miners or Validators Rely on Fees

In Proof-of-Work or Proof-of-Stake networks, validators are usually rewarded with new tokens. But when max supply is reached, those rewards end.

At that point, miners or validators earn only from transaction fees, which can:

- Increase the cost of network usage

- Incentivize faster, more fee-efficient block production

- Raise questions about long-term network sustainability

🕳️ Deflation Over Time (Lost Coins)

Even after max supply is reached, circulating supply may decrease as coins are lost, burned, or forgotten in wallets with lost keys.

This further tightens supply and may contribute to long-term upward price pressure.

🧠 Investor Behavior Changes

When a coin reaches its cap, it often shifts investor mindset toward long-term holding.

Scarcity creates urgency. Traders become holders. Price floors rise. And speculation around the future of that supply dynamic intensifies.

📌 Example: Bitcoin

- Max Supply: 21 million BTC

- Expected to be fully mined by 2140

- After that, miners will rely solely on transaction fees

- Scarcity narrative plays a central role in its value proposition

Hitting max supply doesn’t guarantee price growth — but it removes inflation from the equation, and that changes how both retail and institutional investors approach the asset.

Investment Strategies Based on Circulating Supply

Circulating supply isn’t just a data point — it’s a lens that helps investors understand how a coin might behave, both in the short term and long term.

Here’s how different supply profiles shape different investment strategies:

🔹 High-Supply, Low-Price Coins

Examples: Dogecoin (DOGE), Shiba Inu (SHIB), XRP

These tokens have large circulating supplies — often in the billions or even trillions. Their low per-unit price makes them accessible and psychologically attractive to retail traders.

Pros:

- High liquidity and trading volume

- Appealing to new investors due to “cheap” price

- Often supported by strong community momentum

Cons:

- Harder to achieve sustained price growth

- Scarcity-based value is minimal

- Susceptible to pump-and-dump cycles

Best for:

- Short-term speculation

- Momentum-based trading

- High-volume, low-hold strategies

🔹 Low-Supply, High-Price Coins

Examples: Bitcoin (BTC), Ethereum (ETH), Yearn Finance (YFI)

These projects have limited circulating supply, either by design or through gradual release mechanisms. Prices tend to be higher per unit — and scarcity often drives long-term value perception.

Pros:

- Strong scarcity narrative

- Attracts institutional interest

- Potential for long-term price appreciation

Cons:

- Less liquid in small caps

- Higher price volatility

- Requires patience and conviction

Best for:

- Long-term holding

- Store-of-value positioning

- Scarcity-based investment theses

🔹 Burn-Driven Supply Models

Examples: Binance Coin (BNB), Luna Classic (LUNC)

These tokens are designed with a deflationary mechanism that reduces circulating supply over time via token burns. The idea is to increase scarcity and value as demand grows.

Pros:

- Actively managed supply compression

- Strong incentive for long-term holding

- Can offset inflation from staking or emissions

Cons:

- Requires sustained demand to support price

- Burning without utility = empty mechanic

- Perceived manipulation risk if not transparent

Best for:

- Mid- to long-term holding

- Projects with growing utility and real use cases

Smart investors don’t just look at price. They look at supply behavior, release schedules, burn rates, and lockups — and adjust their timing, expectations, and allocations accordingly.

FAQs About Circulating Supply

Q: What is the best circulating supply for a cryptocurrency

A: There’s no universally “best” number. Low circulating supply can create scarcity and drive up price, while high supply offers liquidity and accessibility. What matters more is how supply aligns with the coin’s utility, demand, and tokenomics.

Q: How does circulating supply affect crypto price?

A: Circulating supply directly influences price through market cap. Lower supply often leads to higher price per coin if demand is strong, while higher supply can keep prices lower unless demand is massive. It also affects volatility and investor sentiment.

Q: Which cryptocurrency has the lowest circulating supply?

A: Some of the lowest include Yearn Finance (YFI) with around 36,000 tokens and Bitcoin with ~19 million in circulation (out of a 21M cap). Low supply coins are often used in scarcity-driven investing strategies.

Q: Does burning tokens reduce circulating supply?

A: Yes. Burning permanently removes tokens from circulation, reducing supply and potentially boosting price if demand holds or increases. Projects like BNB and LUNC use token burns as part of their deflationary models.

Q: Where can I find a coin’s circulating supply?

A: Reputable data aggregators like CoinMarketCap and CoinGecko provide real-time circulating supply metrics, along with total and max supply figures for most major cryptocurrencies.

Conclusion: Why Circulating Supply Shouldn’t Be Ignored

Circulating supply isn’t just a technical detail — it’s a core driver of price, perception, and investment potential in cryptocurrency.

It shapes how coins are valued, how volatile they behave, and how investors interpret long-term opportunity. Whether you’re trading meme coins with massive supplies or holding scarce assets like Bitcoin or YFI, understanding supply dynamics helps you move with strategy — not emotion.

If you’re serious about crypto, stop focusing on just the price.

Start asking: How many tokens are actually in circulation — and what does that mean for the next move?

To learn more about Cryptocurrency go here.