Introduction

Imagine buying Bitcoin for $30,000 on one exchange… and selling it for $30,400 on another — in minutes.

That’s the basic idea behind crypto arbitrage: a high-speed trading strategy that exploits price differences across platforms. It sounds simple. Sometimes it is. But most of the time? It’s a race against fees, delays, and disappearing profit margins.

Because crypto markets are fragmented — spread across global exchanges with different liquidity, volumes, and user bases — the same asset can trade at different prices in different places. Arbitrage traders live in the gap between those prices.

Done right, it can generate consistent profits. Done wrong, it can wipe out your edge before your transaction even clears.

This guide breaks down exactly how crypto arbitrage works, the types of strategies used, the tools that make it possible, and the hidden risks that separate winners from the wrecked.

Key Takeaways

- Crypto arbitrage is the practice of buying an asset on one exchange and selling it on another to profit from price differences.

- Common strategies include spatial arbitrage (between exchanges), triangular arbitrage (within a single exchange), and statistical arbitrage (using algorithms).

- Successful arbitrage requires real-time data, low fees, fast execution, and liquid markets.

- Risks include transfer delays, price slippage, fee stacking, and regulatory restrictions depending on your region.

- Most profitable arbitrage today is done by automated bots — not by hand.

What Is Cryptocurrency Arbitrage?

Cryptocurrency arbitrage is a trading tactic that profits from the price difference of the same crypto asset across different exchanges.

Because crypto markets are decentralized and operate globally, assets like Bitcoin, Ethereum, or USDT can trade at slightly different prices depending on the platform. These differences are caused by variations in supply, demand, liquidity, and trading volume.

Here’s a simple example:

- Bitcoin on Binance: $30,200

- Bitcoin on Coinbase: $30,450

A trader could buy BTC on Binance, transfer it to Coinbase, and sell it for a $250 gain per BTC, minus any fees.

That gap — the arbitrage spread — is the opportunity.

But to turn that opportunity into profit, you have to be fast, fee-aware, and well-prepared.

Crypto arbitrage exists because crypto markets aren’t perfectly efficient. And for traders who know how to move quickly, those inefficiencies can still be monetized.

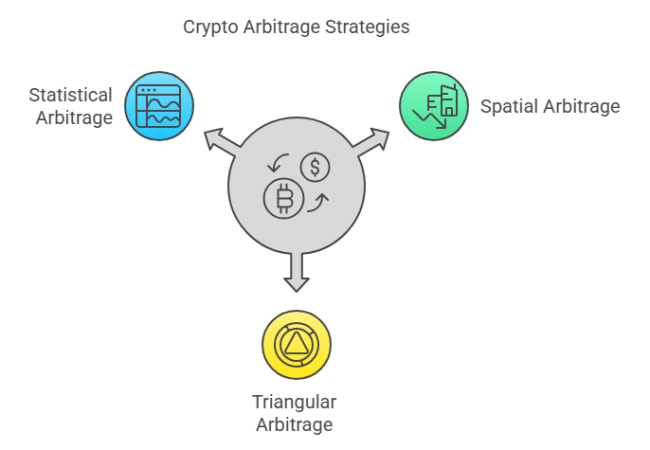

Types of Crypto Arbitrage

Crypto arbitrage isn’t one-size-fits-all. Depending on your tools, capital, and strategy, there are several ways to exploit price gaps.

Here are the three most common types:

1. Spatial Arbitrage

Also known as cross-exchange arbitrage, this is the simplest form.

You buy an asset on one exchange where it’s cheaper and sell it on another where it’s more expensive.

Example: Buy BTC on Kraken → Transfer → Sell BTC on Binance

Pros:

- Easy to understand

- Works across most major coins

Cons:

- Transfer time delays can kill profits

- Fees (withdrawal, deposit, trading) can eat your margin fast

2. Triangular Arbitrage

This strategy happens within a single exchange, using price imbalances between three trading pairs.

Example: BTC → ETH → USDT → back to BTC

If the internal exchange rates are off even slightly, you can end up with more BTC than you started with — purely from price discrepancies between pairs.

Pros:

- No need to move funds across exchanges

- Faster execution

Cons:

- Requires bots or lightning-fast execution

- Only works when spread exists after all fees

3. Statistical Arbitrage

This is the high-tech version. Traders use algorithms and statistical models to detect micro-inefficiencies across hundreds of assets and platforms — often executing dozens of trades per second.

Pros:

- Scalable

- Works even on tiny spreads

- Fully automated

Cons:

- Requires coding skills, bots, and low-latency infrastructure

- Not accessible to casual traders

Each type of arbitrage has its niche. The more competitive the market, the more you’ll need automation, precision, and low fees to win.

Cryptocurrency Arbitrage: How Traders Profit from Arbitrage

In crypto arbitrage, speed and strategy are everything. The price gap isn’t the profit — it’s just the window. Here’s how savvy traders turn that gap into real gains:

1. Spot the Price Difference

The first step is identifying where a coin is undervalued and overvalued.

Tools traders use:

- CoinMarketCap and CoinGecko to monitor price spreads

- Arbitrage scanners like CryptoCompare or proprietary bots

- Exchange APIs for real-time feed access

The goal: catch the gap before the market closes it.

2. Choose the Right Exchanges

Not all platforms are built equal. Smart arbitrageurs target exchanges that offer:

- High liquidity (to enter and exit quickly)

- Low fees (to preserve margin)

- Fast withdrawals and deposits

- Stable infrastructure — no downtime, no slippage surprises

Popular picks: Binance, Kraken, Coinbase, KuCoin

3. Calculate Fees First

Every trade has a cost:

- Trading fees

- Withdrawal fees

- Deposit delays

- Blockchain transfer fees (especially for slower networks)

If the fees outweigh the spread, there’s no trade.

- Pro arbitrageurs build fee calculators directly into their bots to filter bad trades in real-time.

4. Execute Fast — Or Don’t Bother

In crypto, price gaps close in seconds. Traders use automated bots or pre-funded accounts on multiple platforms to skip delays.

Manual trading? It’s mostly dead. Unless the gap is massive, bots win 99% of the time.

Arbitrage isn’t about finding opportunity. It’s about exploiting it faster than anyone else — with fewer costs and fewer mistakes.

Risks of Crypto Arbitrage

Arbitrage sounds like easy money — but in reality, the margin for error is razor thin. One delay, one miscalculation, one fee you didn’t factor in… and the profit disappears.

Here are the biggest risks that kill arbitrage trades:

🔄 Transfer Delays

Moving crypto between exchanges isn’t instant.

Network congestion, wallet confirmations, or manual approval queues can turn a profitable gap into a loss before the funds even arrive.

💸 Fee Stack

Every arbitrage trade comes with multiple hidden costs:

- Exchange trading fees

- Blockchain network fees

- Withdrawal and deposit charges

- Slippage due to low liquidity

If you don’t calculate them upfront, you’ll be trading at a loss — even if the price gap looks solid.

🧊 Liquidity Issues

Some exchanges show big price differences — but have very low volume.

You might enter a trade, but find there’s no one on the other side to exit it. Now you’re stuck holding an asset you can’t sell without crashing the price.

⚠️ Regulatory Restrictions

In some countries, crypto trading — or even moving funds between exchanges — is restricted or closely monitored.

That can lead to frozen assets, delayed withdrawals, or legal consequences if you operate without understanding the rules.

🧠 Execution Lag

By the time you spot the opportunity and try to act… it’s gone.

This is why most profitable arbitrage today is done with fully automated bots — not human reflexes.

In arbitrage, speed protects profits — but only if you’ve already accounted for every risk that can erase them.

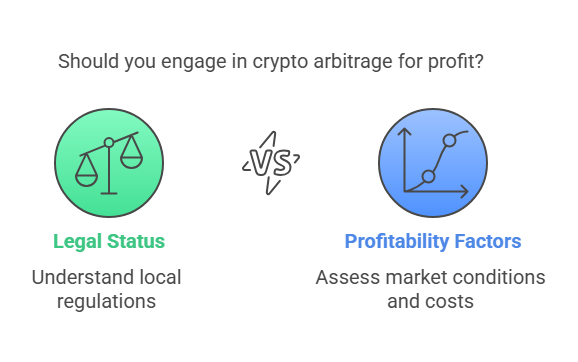

Is Crypto Arbitrage Legal?

Yes — crypto arbitrage is legal in most jurisdictions.

But the way you execute it, where you live, and which exchanges you use can drastically affect what’s allowed and what’s risky.

Here’s how it breaks down:

🇺🇸 United States

Crypto arbitrage is legal, but heavily regulated. You must report all capital gains and trading activity to the IRS.

Many U.S. traders use platforms like Coinbase or Kraken, which issue tax forms — but moving funds between international exchanges can create compliance risks.

🇨🇳 China

Cryptocurrency trading is restricted, and most domestic platforms have been shut down.

While VPNs and offshore exchanges are used unofficially, arbitrage here operates in a legal gray zone — with real consequences if caught.

🇪🇺 Europe & UK

Arbitrage is legal, but exchanges must meet KYC and AML requirements.

Traders must report income and capital gains, but can operate freely across regulated platforms.

🌍 Other Regions

Regulations vary widely. Some countries tax crypto gains aggressively. Others don’t tax them at all.

Before you start arbitraging internationally, check:

- Tax laws on crypto profits

- Exchange licensing in your region

- Restrictions on cross-border transfers

Legality isn’t just about the trade — it’s about your entire setup.

Where your accounts are based, how you fund them, and how you report gains all matter.

Can Arbitrage Make You Rich?

It’s possible — but unlikely without capital, automation, and discipline.

Crypto arbitrage isn’t like buying a moonshot altcoin. It’s not a lottery. It’s a game of thin margins, fast execution, and repeatable strategy. And the bigger your capital, the more those tiny wins start to compound.

Here’s what determines your success:

⚙️ Automation

Manual arbitrage is mostly obsolete. The best opportunities last seconds, not minutes. Bots scan hundreds of pairs across exchanges in real-time and execute instantly. Without automation, you’re too slow to compete.

💰 Capital

Many arbitrage spreads are only profitable in volume. If you’re making $20 per trade, you need size and speed to make that worthwhile. And you need funds preloaded across multiple exchanges to avoid transfer delays.

🧠 Execution Precision

Every dollar counts. Profits disappear if you miss a network fee, miscalculate slippage, or trade during low liquidity. Winning arbitrage traders operate like high-frequency machines, not gamblers.

So… can you get rich?

Yes — if you think like a quant, move like a machine, and scale like a business.

But if you’re just looking for fast money? There are easier ways to get wrecked.

FAQs About Crypto Arbitrage

Q: Is crypto arbitrage still profitable in 2025?

A: Yes, but only with the right tools. Profitability depends on market volatility, fee efficiency, and execution speed. Most consistent profits today come from automated bots and well-optimized strategies.

Q: What are the best platforms for crypto arbitrage?

A: Binance, Coinbase, Kraken, KuCoin, and OKX are top picks due to high liquidity, fast execution, and wide pair listings. For best results, keep funds distributed across multiple platforms.

Q: Can I lose money doing arbitrage?

A: Absolutely. If you underestimate fees, hit transfer delays, or get caught in slippage or volatility, the profit margin can vanish — or flip to a loss.

Q: Is triangular arbitrage still viable?

A: Yes, especially on high-volume exchanges. But it requires precision and automation, since profitable loops disappear fast and depend on low fees.

Q: Can I make a living from crypto arbitrage?

A: Some traders do — but it requires high capital, automation, and constant optimization. It’s not passive income. It’s a fast-moving business model with tight margins.

Conclusion: Arbitrage Isn’t Easy Money — It’s Precision Work

Crypto arbitrage sounds simple: buy low on one exchange, sell high on another. But behind every profitable trade is a system — not a guess.

The real edge isn’t in spotting price gaps. It’s in moving faster than everyone else, managing fees, staying compliant, and executing with machine-like precision.

For casual traders, arbitrage can be a fun experiment. For professionals, it’s a volume game built on automation, infrastructure, and discipline.

Yes, profit is possible. But only if you treat arbitrage like a strategy — not a shortcut.

🔗 Explore more crypto trading tactics in The Cryptocurrency Glossary Page.

Next: Read The Crypto trading for beginners Guide.