Introduction

The hype is deafening. AI is rewriting the rules. Crypto is breaking them. And somewhere in the middle, something massive is happening but barely anyone’s explaining it clearly.

AI crypto isn’t just a trend. It’s a collision.

On one side: unstoppable algorithms that can predict, optimize, and evolve without rest.

On the other: decentralized systems that don’t need permission to disrupt billion-dollar industries.

Together? They’re building financial ecosystems that don’t just run on code, they think in it.

So no, this isn’t just about a few tokens pumping. It’s about smarter blockchains, autonomous economies, and code that adapts in real time.

And while most people are distracted by the noise… a handful of projects are laying the tracks for where money, markets, and machine intelligence are headed next.

This guide isn’t here to hype coins. It’s here to show you what’s real, what’s risky, and what’s actually worth watching in AI crypto right now.

Key Takeaways

- AI crypto merges artificial intelligence with blockchain to create smarter, adaptive, and more efficient digital systems.

- Real use cases include: AI-powered trading bots, fraud detection, autonomous smart contracts, and decentralized AI marketplaces.

- Top projects to watch: SingularityNET (AGIX), Fetch.ai (FET), and Render (RNDR) each solving different real-world problems.

- This sector has upside… but volatility, regulatory chaos, and overhype make it dangerous if you don’t understand the fundamentals.

- 2025 may be the inflection point where AI-enhanced crypto stops being an edge… and starts becoming the infrastructure.

Leading AI cryptocurrencies: SingularityNET (AGIX), Fetch.ai (FET), Render (RNDR).

What Is AI Crypto, Really?

Let’s get this straight: AI crypto isn’t just “tech meets tokens.”

It’s not ChatGPT slapped onto a blockchain. It’s not magic internet robots trading coins while you sleep.

And it’s definitely not some imaginary future you’ll read about in Wired next year.

AI crypto is the brain upgrade for the decentralized world.

Here’s what that actually means:

- It’s where smart contracts stop being dumb scripts and start adapting based on real-world data.

- It’s where blockchains don’t just store info, they analyze it, predict what happens next, and automate decisions humans used to slow down.

- It’s systems that don’t just execute code… they optimize themselves while they do it.

Think:

- Trading bots that evolve faster than any hedge fund

- Identity systems that verify without human bias

- Marketplaces where AI agents negotiate on your behalf in real time, 24/7, with zero middlemen

This isn’t theoretical. It’s already happening.

And it’s creating a new category of crypto, one where the network doesn’t just run… it thinks.

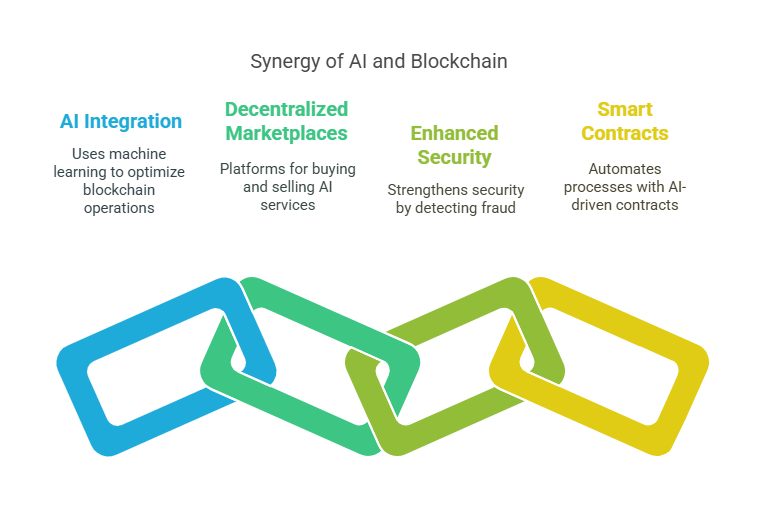

How AI + Blockchain Work Together (and Why It Matters)

Most people treat AI and blockchain like two separate buzzwords in a VC pitch deck.

But when you stitch them together?

You get systems that are decentralized by design and intelligent by default.

Here’s what that actually looks like in the wild:

AI Feeds the Brain

AI ingests massive datasets, spots patterns humans would miss, and makes predictions faster than any spreadsheet jockey alive.

On-chain, that means smarter everything:

- Trading strategies that learn and evolve

- Risk models that auto-adjust in real time

- Scams flagged before the damage is done

Blockchain Locks the Skeleton

Blockchain gives AI something it’s always lacked: a trusted memory.

- Every prediction is verifiable

- Every transaction is immutable

- Every rule is enforced without bias, corruption, or interference

No closed servers, centralized black boxes. And no “take our word for it” platforms.

Just transparent, decentralized intelligence.

Smart Contracts… Just Got Smarter

Basic smart contracts do what you tell them. AI-powered smart contracts decide what to do based on live conditions.

Example? An AI-driven DeFi protocol could adjust loan rates dynamically factoring in market volatility, borrower behavior, even macroeconomic signals.

No votes. No delays. Just real-time execution that learns.

Built-In Defense Systems

AI models can be trained to detect anomalies, exploits, and bot behavior before they trigger catastrophic losses.

Add that to blockchain’s audit trail, and you get a self-defending system.

Why It Matters

We’re moving from blockchains that just store state… To blockchains that predict, optimize, and act.

It’s not just about adding AI to crypto. It’s about giving decentralized networks a brain and watching them outmaneuver the old system in real time.

Top AI Crypto Projects That Deserve Your Attention

Everyone wants to know: “Which AI coin is about to explode?” Wrong question.

The better one is: Which projects are solving problems that actually need AI + blockchain to work?

These aren’t hype tokens riding a trend. These are infrastructure plays, positioned to power the next phase of intelligent, decentralized systems.

1️⃣ SingularityNET (AGIX) The AI Marketplace for a Decentralized World

SingularityNET isn’t just another platform.

It’s building an open market where anyone can create, share, or monetize AI services—without gatekeepers.

- Developers upload machine learning models

- Users tap into those models and pay in $AGIX

- The entire economy runs peer-to-peer, no Big Tech middleman needed

It’s like the App Store, if the App Store was owned by no one and run by code.

And with partnerships from DeFi to robotics, AGIX is becoming the AI layer for everything blockchain can’t do alone.

2️⃣ Fetch.ai (FET Autonomous Agents That Think for You

Fetch is building autonomous economic agents not bots, not contracts, but digital entities that act on your behalf.

They:

- Scan DeFi protocols for optimal trades

- Negotiate data access

- Automate supply chain decisions

- And yes… they do it without ever asking permission

This isn’t fantasy. It’s live. And as networks, devices, and dApps get smarter, Fetch is building the agents that will move through them like neurons.

$FET powers the whole ecosystem.

3️⃣ Render (RNDR) AI-Powered Rendering for the 3D-Driven Future

Imagine the metaverse, gaming, design, and AI creation tools… all fighting for GPU power.

Render steps in with decentralized rendering at scale powered by blockchain, optimized by AI.

- Artists send rendering jobs to the network

- Nodes with spare GPU capacity take the job and earn RNDR

- AI helps route jobs, optimize performance, and scale globally

As digital worlds grow and creative demands spike, Render may be the invisible engine behind what we see next.

Bonus Mentions (Emerging + Speculative)

Keep an eye on:

- Cortex (CTXC): AI inference on-chain

- Velas (VLX): AI-enhanced Solana fork with speed ambitions

- Numerai (NMR): AI-powered hedge fund meets tokenized staking

Not all will survive. But the ones solving infrastructure-level problems?

Those are the ones to watch.

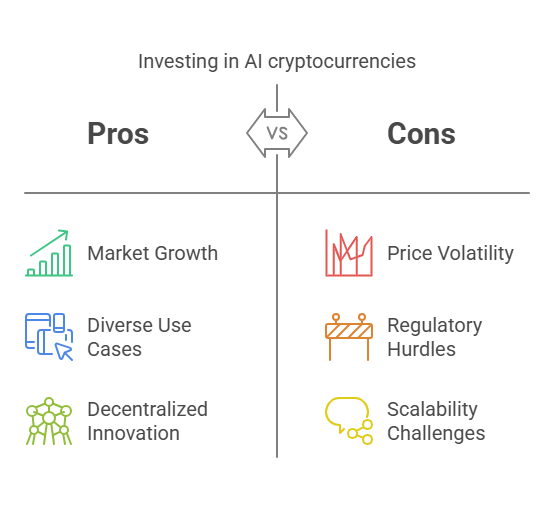

Opportunities (and Real Risks) in AI Crypto

Here’s the truth: AI crypto could 10x your expectations… or vaporize your money.

This space is not for blind optimism. It’s for clear-eyed curiosity and calculated risk.

Let’s break down where the real upside lives and where the cliffs are hiding.

💡 The Opportunities

✅ Exponential Growth Curve

AI crypto is riding two adoption curves at once:

The AI wave, projected to hit $1.8 trillion by 2030

And the blockchain explosion, eating legacy finance piece by piece

Together, they’re not just growing, they’re compounding.

✅ New Revenue Models

You’re not just investing in coins.

You’re gaining access to:

AI model marketplaces (AGIX)

Autonomous transaction agents (FET)

GPU compute economies (RNDR)

It’s software + hardware + finance, decentralized.

✅ First-Mover Advantage

Most investors still think AI crypto is “future tech.”

They don’t see that it’s already building roads under Web3, Web2, and even legacy systems.

Early users, builders, and holders aren’t late. They’re front row to the next evolution of infrastructure.

⚠️ The Risks

❌ Extreme Volatility

AI crypto tokens can spike 60% in a week… and drop 40% the next.

The hype cycle moves fast and retail investors usually find the top after it passes.

If you’re not using stop-losses or tracking actual adoption metrics, you’re gambling.

❌ Overhyped Narratives

A lot of coins are slapping “AI” on their pitch deck to pump price.

But without real use cases, user traction, or functioning tech, they’re just tech-themed lottery tickets.

Don’t confuse innovation theater with execution.

❌ Regulatory Crossfire

AI and crypto are both on regulators’ radars. Mix them? You’re painting a target.

From data privacy laws to algorithmic trading bans, one bad headline could nuke a project’s future.

If a protocol can’t survive outside of hype or loopholes… it won’t survive long-term.

Final Word on Risk

AI crypto is not “safe.” But it’s one of the few sectors where smart risk = smart reward.

You don’t win here by going all-in. You win by going in informed.

AI Crypto Market Trends to Watch in 2025

Want to know which AI crypto will “moon”? Wrong question again.

You don’t watch coins. You watch infrastructure shifts, tech pivots, and behavior changes.

Here’s what’s actually driving the AI crypto space into its next phase and why 2025 could be the year it goes from speculative to systemic.

🔸 The Rise of Decentralized AI Models

Centralized AI? Owned by megacorps. Decentralized AI? Trained, shared, and monetized by anyone.

Projects like SingularityNET and Ocean Protocol are building frameworks where:

- Developers don’t need to sell to Big Tech

- Data providers earn directly from their data

- Intelligence becomes open-source, not walled-off

This isn’t just a feature, it’s a revolt.

🔸 Institutional Players Are Quietly Moving In

Hedge funds, sovereign wealth, and VC firms aren’t betting on meme coins.

They’re backing protocols that automate trading, optimize smart contracts, and crunch data in real time.

AI crypto is no longer just a DeFi playground, it’s a research lab for serious capital.

🔸 Self-Evolving Smart Contracts

Think of contracts that don’t just execute code, they rewrite their logic based on:

- Market volatility

- External APIs

- Machine learning models

2025 may see the rise of autonomous DeFi, where protocols govern themselves dynamically with little to no human input.

🔸 Cross-Chain AI Collaboration

AI won’t stay siloed on Ethereum.

You’ll see multi-chain intelligence platforms:

- Learning across networks

- Sharing compute

- Trading insights peer-to-peer

This makes every blockchain smarter not just the ones with built-in AI tooling.

🔸 On-Chain AI Identity & Reputation

As bots get smarter and scams get harder to detect, we’ll need proof of intelligence as much as proof of work.

Expect tools that:

- Score wallets based on behavior

- Detect synthetic users

- Authenticate agents based on logic patterns, not logins

AI isn’t just changing how we use crypto, it’s about to change who’s allowed to use it.

2025 won’t be about who shouts “AI” the loudest. It’ll be about who quietly builds the stack everyone else ends up depending on.

❓ Frequently Asked Questions

What is AI crypto?

AI crypto refers to blockchain-based projects that integrate artificial intelligence to automate decisions, analyze data, enhance smart contracts, and optimize decentralized systems. It’s where machine learning meets permissionless infrastructure.

Which AI crypto is the best?

There’s no universal “best,” but some of the most respected AI crypto projects include:

- SingularityNET (AGIX) — Decentralized AI marketplace

- Fetch.ai (FET) — Autonomous agents for DeFi and supply chains

- Render (RNDR) — AI-enhanced GPU rendering on a decentralized network

Each solves a different problem. The key is understanding the use case—not just the token price.

What AI crypto will explode in 2025?

No one can predict with certainty, but coins with strong fundamentals, active development, and real-world adoption like FET, AGIX, or RNDR are being closely watched by early institutional players and informed retail investors.

How do AI and blockchain work together?

AI brings intelligence. Blockchain brings trust. Together, they create systems that can:

- Automate complex financial processes

- Detect fraud in real time

- Self-optimize based on market or user data

- Operate 24/7 without human input

It’s decentralized logic… with a brain.

Is AI crypto legit or just hype?

Both exist. Some projects are solving real infrastructure problems. Others are slapping “AI” on a coin to ride the trend. If there’s no tech, no users, and no whitepaper worth reading, it’s probably noise.

How can I invest in AI crypto?

You can buy AI-related tokens on major exchanges like Binance, Coinbase, or Kraken. Always use a secure wallet and research the project’s utility not just its price history. Our Crypto Tools Hub can help you get started safely.

What’s the biggest risk in AI crypto?

Overhype and underdelivery. Many projects sound brilliant on paper but lack execution. Also, regulatory risk is growing, and AI-heavy protocols could attract even more scrutiny than standard DeFi.

Final Thoughts: Not Just a Trend, A System Shift

You came here looking for coins. What you found was something bigger.

AI crypto isn’t just “what’s hot.” It’s a signal.

Blockchains are learning. Smart contracts are evolving. Systems are starting to think, adapt, and move without middlemen or even humans.

This isn’t just a new investment category. It’s the foundation of a decentralized intelligence layer that may power everything from finance to logistics, media to machines.

And the best part?

You’re still early.

Not early to speculation.

Early to the infrastructure shift most people haven’t realized is already happening underneath them.

You don’t need to FOMO into every AI token. You just need to know what this movement actually is and how to spot the builders, not the noise.

So whether you’re here to research, invest, or build remember: The smarter the system, the faster the curve. And this curve is just starting.

Next, read more crypto terms here.

There’s a Reason 24 Million Traders Are Using This Instead

Practice in real markets, zero pressure.

When you’re ready, go live with no commissions.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and you should always do your own research or consult a professional before making any financial decisions. Cryptocurrencies are volatile and involve significant risk of loss. Past performance is not indicative of future results.